Insert Key Skills Of A Loan Officer

With a well-structured skills section in the loan officer resume, you can demonstrate your strengths and showcase your ability. By grasping your skills, employers can decide whether you are the best fit for the vacancy.

Reminder: The desired skill list should consist of both soft and hard skills.

For a consumer loan officer resume, these are the most needed skills to list down:

Soft skills

- Organizational skills

How To Write A Loan Officer Resume Summary Or Resume Objective

Your resume summary or objective is like your first impression to hiring managers. Its the first thing theyre going to read after your name and contact information. Its the first true taste of what you can bring to the table as a loan officer. In other words, it needs to be perfect!

But first things first, whats the difference between a loan officer resume summary and a resume objective?

- Resume summary A short explanation of your professional experience.

- Resume objective A quick description of your overall career goals.

No matter which one you decide to use, your resume summary or objective should be full of detail and be short enough to fit into two or three sentences. Think of it like the action-packed movie trailer enticing the viewers to want more.

top tip

Resume summaries are best for applications with professional experience, while resume objectives are better for entry-level applicants who might not have professional experience to summarize.

Education & Mortgage Credentials

Education is a cornerstone of many resumes. The mortgage world is no different. In addition to your current level of education whether that be a high school diploma, a bachelors degree, or even your Ph.D. youll want to include that youve completed your mortgage education and have obtained a license in the state with which you intend to work. This shows potential employers and recruiters that youre set to hit the ground running.

Recommended Reading: How A Resume Should Look 2020

Get A Second Opinion Before Authorizing Your Resume

As a loan officer, you understand the process of reviewing and authorizing loan applications better than anyone. Now, let the resume experts at Monster review and authorize the final version of your loan officer resume. An experienced resume writer with a background in banking will analyze your resume for errors, write a compelling and fully customized professional summary, and add relevant industry keywords to help your resume pass applicant tracking software. Once weve put our stamp of approval on the final version, youll be ready to apply to any loan officer job.

Get great content like this and the hottest jobs delivered to your inbox.

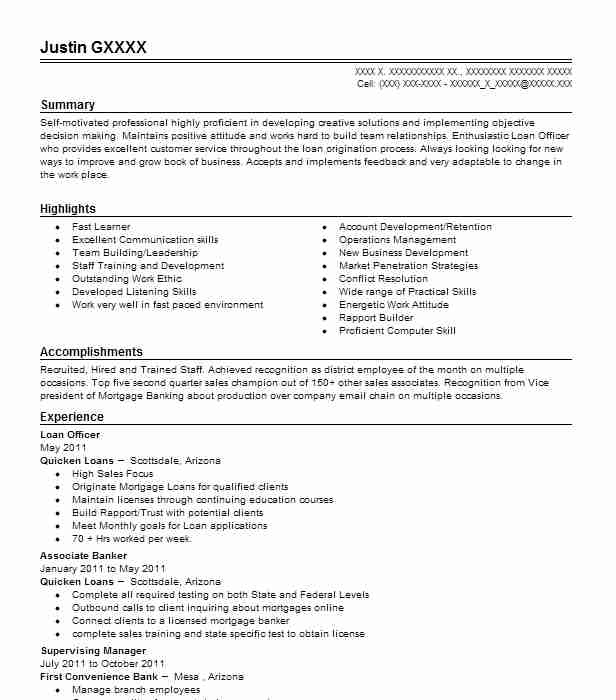

Professional Summary For A Loan Officer

The professional/resume summary introduces your resume by briefly summarizing your top achievements, skills, and experience.

Think of it as a sales pitch where you only have a few minutes to convince the other person to buy into what youre selling. The goal of this section of your resume, which comes right after the header, is to convince your prospective employer to read the rest of your resume.

You May Like: How Do You Spell Work Resume

Senior Loan Officer Resume Samples

A Senior Loan Officer will assist the loan applicants and ensure fast loan sanctions by undertaking various tasks. The most common duties shouldered and listed on the Senior Loan Officer Resume include the following providing loan applicants information about loan and its terms, gathering financial information, verifying the credit score and the financial history of the applicant, justifying decisions like approving and rejecting the applications, completing loan contracts, maintaining and updating account records, assessing customers needs, and operating in compliance with stipulated laws.

Those interested in this line of activity must depict on the resume the following skills a deep understanding of lending procedures, selling abilities, researching skills, familiarity with computers, knowledge of banking applications and software solid understanding of direct and indirect lending activities, and excellent communication skills. Employers want to see qualifications in Economics or finance fields on the applicants resume.

Loan Officer Resume Objective Example

What happens if you dont have experience to summarize? Thats where a resume objective comes in.

A resume objective is a brief description of your overall career goals with a few of your most impressive skills thrown in. Just like the resume summary, it should also be around two to three sentences long just enough to give hiring managers a taste of what you bring to the table.

Also like a resume summary, you should also be as detailed and specific as you can be without going on and on. And it never hurts to throw in a few numbers and statistics, if you can.

Heres an example of what a good loan officer resume objective might look like:

Right

Dedicated and detail-oriented business graduate with 4+ years of experience working in customer-facing roles, seeking to help ResumeGiants Finance Group become a market leader in the finance industry. Academic background in accounting and comfortable working in a fast-paced environment. Highly proficient with computer software, including QuickBooks and Microsoft Office.

This applicant might not have professional loan officer experience, but the skills and background they include are detailed and relevant to the position they want. They didnt mention their customer-facing roles included retail and restaurant work, but if it teaches you to work with customers, its relevant!

top tip

You May Like: Does Your Resume Need To Be One Page

Loan Officer Resume 1

T: 0044 121 638 0026E: info@dayjob.com

PERSONAL SUMMARY

A talented Mortgage Loan Officer who has a track record of proactively selling a companys conventional mortgage and home equity loans. Maxine has a passion for service, a drive to achieve results, and wants to be part of a company that is committed to serving the customers and communities in which it does business. She exercises a high level of professionalism and tactful judgment at all times, and will have no problem serving as a liaison between the customer, the loan company and a underwriting department. Her key skills include developing profitable customer relationships and executing effective mortgage marketing plans. Right now she would like to work for a company that has a culture of operational excellence.

CAREER HISTORY

Loan Officer Start Date PresentEmployers name LocationResponsible for listening to and analysing a client needs and then presenting them with a loan that will meet their precise requirements.

Duties

Format Your Resume Like A Professional

Individuals in the fields of accounting and finance have very professional jobs. Therefore, if you’re applying to the position of a loan officer in this field, it’s important for your resume to look as professional as you are.To truly impress hiring managers, it is crucial to correctly format your resume. There are three ways to choose from to correctly format your resume:

As a loan officer, you can work with whichever of these three formats you feel most comfortable with. If you’ve got tons of experience and have managed loans for multiple companies, then having your resume formatted in reverse-chronological order can help you highlight the work you’ve done.If you’re new to the field and have more skills to offer than actual experience, considering selecting to format your resume in a functional way.If you’ve got both and really want to impress hiring managers with your skills and experience, then going with a resume formatted in a hybrid style will help your resume not only stand out, but also look professional.It’s also important to include these certain details in your resume:

- Contact information

Tip: Make sure to look over the posted job description and implement some keywords listed on the job you are applying for when creating your resume.

Read Also: Do Resumes Need An Address

Describe Your Work Experience

To be hired as a loan officer, you need to show hiring managers that you have experience with loans and know how to finance them and evaluate them. Therefore, what you put under work experience is essential.When listing your work experience, it is important to go in reverse-chronological order so hiring managers know what was your most recent job experience and what you learned or mastered in that job.

Tip: It’s also important to highlight the specifics you did on the job and do so using good verbs.

As a loan officer, here are some job description examples you can include in your resume:

If you’ve been a loan officer assistant, here are some job description examples, too:

Tip: When adding your work experience to your resume, you should always include the company you worked for, your job title, your time there, and the location along with the description of what you did.

Want more tips and tricks on how to write your work experience description? Check out our guide on describing your work experience.

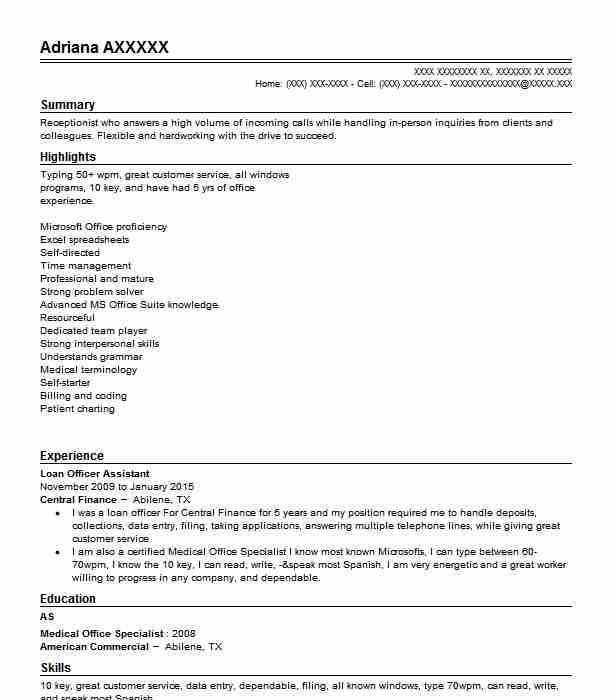

Mortgage Loan Officer Resume

Objective : To obtain employment, again after choosing a long leave of absence to devote to my family. would like an employer that will overlook my lengthy employment gap, and see the array of my extensive skills and experience that can only contribute to any company as well as bringing myself to be part of a team again that I can share my skills and learn new ones along the way.

Skills : < div> Financial skills, Time management skills, Knowledge of financial software.< /div>

Description :

- Approved loans within specified limits, and referred loan applications outside those limits to management for approval.

- Met with applicants to obtain information for loan applications and to answer questions about the process.

- Analyzed applicants’ financial status, credit, and property evaluations to determine feasibility of granting loans.

- Explained to customers the different types of loans and credit options available, as well as the terms of those services.

- Obtained and compiled copies of loan applicants’ credit histories, corporate financial statements, and other financial information.

- Reviewed and updated credit and loan files.

- Sent approved loan documents to underwriting with specified limits.

Don’t Miss: How To Delete Resume From Linkedin

Example For Beginning Loan Officers

- Assessed applicants financial status, credit history, and property assets to determine the possibility of granting a loan.

- Analyzed various loan programs and advised clients on the best option for them depending on their profile.

- Submitted loan applications and oversaw the loan origination process according to company policies.

- Assisted the senior loan officer in reviewing loan applications and the clients financial information before loan approvals.

How To Describe Your Loan Officer Experience On Your Resume

Your resumes experience section is a lot like a loan applicants credit score: Its arguably the most important part! Not only does your professional experience show hiring managers that you have the skills to hold down a job, but you can also put those skills into practical use.

To write an effective loan officer resume education section, you need to address three key points about your past professional experience:

- Key accomplishments

- Responsibilities

Naturally, you have years and years and years of incredible experience youd love to talk about, but hiring managers dont have time to read through five pages of experience. Instead, try to limit your experience section to the top 3-7 examples. Just make sure your resume still fits on one page!

top tip

Every item in your resumes experience section should be relevant to the job youre applying to. Employers looking for a loan officer dont entirely care about the summer you spent mowing yards in your neighborhood, unless you can explain how its relevant to being a loan officer!

If you want to make your experience section stand out , here are a few time-tested resume-building tips to keep in mind:

- Use plenty of numbers and statistics when you can.

- Customize your work experience to fit the job youre applying to.

- Keep all information short, concise, and to the point.

- Include keywords from the job description.

Read Also: Resume Writing Services Dallas

List Languages On Your Resume

As a loan officer, you meet a variety of people, some of whom may speak different languages. Adding a languages section to your resume may be what you need to take your resume to the next level and get the job.Being multilingual is essential as a loan officer because knowing more than one language also helps to improve your verbal communication and makes you more precise and logical in your problem-solving. Ã Here are some languages you can include on your resume if you know them:

How To Add Other Sections For An Effective Resume

Is there still more you want to say about yourself? Of course there is youre awesome! When theres information you want to include on your resume that doesnt fit into the standard resume sections, thats where other sections come in.

Other sections are simply additional sections dedicated to information that doesnt fit anywhere else. They can be whatever you want as long as theyre relevant to the position youre applying to.

Recommended Reading: Mcdonalds Job Description Resume

What Is The Best Resume Format For A Loan Officer

Most of the time, deciding the type of resume format to use is determined by the applicants specific purposes. For freshers who are drafting an entry-level loan officer resume, it seems to be more difficult to pick a suitable format.

No need to panic! Let us walk you through this.

There are four commonly-used types of resume formats:

Chronological resume format:

Your loan officer resume is presented in a reverse-chronological order with the latest experience and achievements listed first. The format best fits someone with intensive work experience. It is also the default format that most people can easily read and understand.

Functional resume format:

Its a skill-based type of format that highlights your skills and personal traits that may benefit you at work. Specifically, if you are a fresh graduate or drafting a loan officer assistant resume, this format can help you demonstrate your strengths instead of showcasing employment history.

Hybrid resume format:

This type of format is a combination of the chronological and functional format. Not only does it list down relevant skills but it also presents working history. You may consider this format while writing an experienced credit officer resume.

Targeted resume format:

A commercial loan officer resume with this format type will be greatly customized with keywords to tackle the requirements shown in the job description. Thus, it’s beneficial for those who are applying for a highly competitive position.

Write A Remarkable Cover Letter Along With Your Resume

Some jobs might ask you not to send a cover letter, but we always recommend attaching it with your resume if this is not the case.

Cover letters let you portrait your passion for the job and highlight even more aptitudes. They give you a chance to showcase your writing skills and persuade the recruiting manager to continue reviewing your application.

Use these cover letter examples to create yours in no time.

You May Like: How To Include A Minor On A Resume

Showcase Your Loan Officer Skills With A Balance Of Hard And Soft Skills

While hard skills are essential to get the job done, loan officers must also have excellent soft skills to secure new business from interested borrowers.

Read the loan officer job description carefully and identify which skills the hiring manager requires for the position. Then, list these in the skills section of your resume.

Here are examples of top hard and soft skills for your loan officer resume:

Hard skills to put on a loan office resume

- Accounting software

- Banking knowledge

- Financial software

- Mortgage loan processing

- Microsoft Office

Soft skills to put on a loan officer resume

- Analytical thinking

The Best Loan Officer Skills For A Resume

Theres no doubt you have the skills necessary to be the best loan officer of all time, but employers might not know that. To prove your skills, add a skills section to your resume.

Your resumes skills section should just be a list of relevant skills that you possess. This makes it easy for hiring managers to scan your resume quickly and get a feel for what you can bring to the job.

Resume skills can be divided into two categories:

- Hard skills Concrete, measurable skills.

- Soft skills Universal, harder-to-define skills.

Hard skills are something you can get a certification or degree in, like specific accounting software or loan processing procedures. Soft skills are more like personality traits, like analytical skills or communication.

Here are some of the top hard and soft skills to include in a loan officer resume:

Soft Skills

- Underwriting procedures

Recommended Reading: Where Do You Put Your Education On A Resume

Writing A Memorable Experience Section: Loan Officer Resume Edition

Checklist: Ways to Make Your Experience Section Stand Out

- Find balance: use 4-6 bullet points per position

- Include positions that are relevant to the job youre applying for

- Use action verbs when describing your responsibilities and results

- Highlight your achievements by adding numbers to them

- Prove that youre willing to work hard, both individually and in a team.

Weve gathered the most impressive Loan Officer experience sections from real Enhancv resumes. Check them out for some additional inspiration!

PRO TIP

Check the Loan Officer job description for inspiration. Look for similarities between your employers values and your experience.

Cv Skills Example: Appraise Your Attributes

Honing the skills section of your loan officer CV requires an examination of your attributes plus analysis of the specific skills your targeted employer seeks. Not all jobs are the same, so be careful that you choose the 4-7 top skills you have that match the role.

Loan officers need hard skills such as knowledge of financial software and analysis and soft skills such as sales ability and attention to detail. Start out by creating a master list of all your hard and soft skills. Then, choose those most relevant to each position.

- Analytical Thinker

You May Like: Examples Of Basic Resumes