What Are Examples Of Strong Bullet Points I Can Include On My Accounting Resume

Audited departmental acquisition protocols and recovered $10M in overstated expenses.Managed a team of 13 tax specialists, increasing divisions revenue by 15% year-on-year.Implemented simpler journaling systems using Excel for a team of 70+ accounting clerks, reducing closing time by an average of 3 days.

Cpa S Wanted For Prestigious Global Companyresume Examples & Samples

- Assuring accuracy of General Ledger

- Budgeting and Forecasting

- Bachelors Degree in Finance, Accounting or Business

- Strong working knowledge of Excel is required

- Bachelors degree in Accounting / Finance required. Masters degree preferred

- CPA required. CISA preferred

- Public accounting and internal auditing experience required

- At least three years of experience designing, implementing, testing and monitoring internal SOX controls

- Minimum 3 years of general accounting experience with sound knowledge of GAAP

- Experience auditing with a public accounting firm required

- Monthly P& L close and balance sheet analysis experience required

- Strong Excel skills

- Experience with large ERP software

- Solid analytical, problem solving, verbal and written communication skills

- Bachelors degree in Finance/Accounting required

Quantify Your Accountant Skills In A Work Experience Section

Put your accounting skills in context with specific examples and hard numbers in your resumes work experience section. Providing context for your skills shows the employer that you produce results.

Here are examples of data to include on your resume:

- Amounts of money you saved

- Percentage of profit you increased

- Number of accountants supervised

- Size of budget managed

- Number of clients served

Don’t Miss: How To List Certification In Progress On Resume

Refer To Online Cpa Resume Templates Or Examples

Certified public accountant resume examples serve more purpose than telling you what a typical CPA resume should look like they can also help you jog more ideas.

Whether you search for CPA resume examples for people looking for entry-level jobs or experienced job seekers, make sure to use them to your advantage.

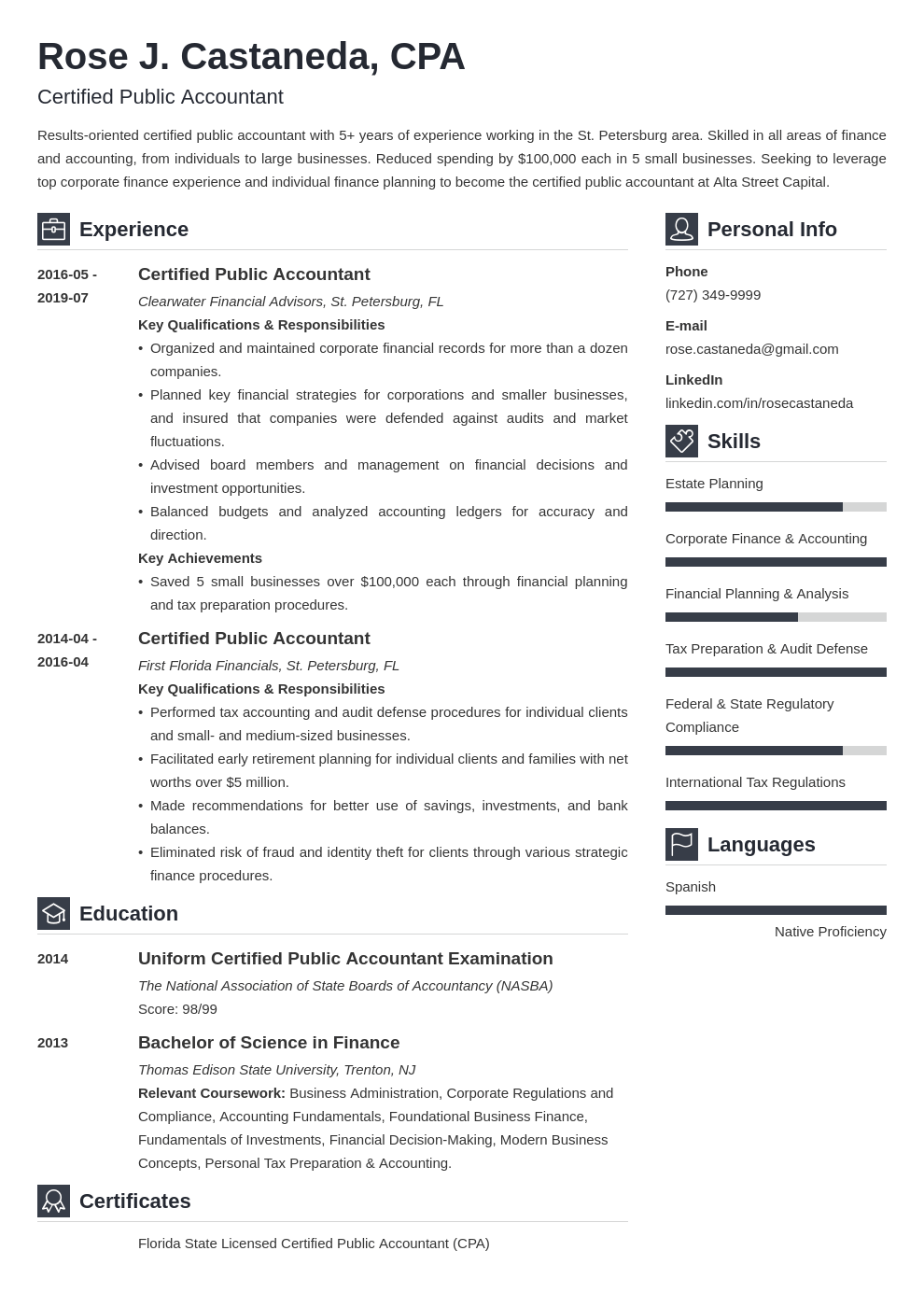

Start With Your Contact Details

The first step in creating an effective resume is to list your contact details at the top. Using your information as a header ensures that a recruiting manager can easily locate your details if they wish to contact you. It also structures your resume and gives it a professional look. Your contact details can include your full name, current professional title, phone number, email address and the city where you live.

Don’t Miss: Where To Put Cpr Certification On Resume

Resume Examples & Samples

- Bachelors Degree in Accounting, Masters Degree Preferred

- Must have 3 to 5 years accounting experience, preferably in public accounting, large industry or health care industry

- Strong financial analysis skills with proficiency utilizing Excel MS Access experience a plus

- License/Certificates: Certified Public Accountant preferred

Discuss Your Professional Experience

Work experience can be especially important in a CPA resume. This is because many accountants can qualify for higher-paying jobs when they have experience in multiple areas of accounting. To format this section, start each entry with the job title you held and the duration of your employment. Then, you can add other details like the name of your employer and a few of your typical job duties. It can be common to include two or three entries in this section to ensure the resume can remain on a single page while still showcasing your professional background.

Don’t Miss: What Does A Thumbs Up On Ziprecruiter Mean

Consider Adding Details On Related Skills

You can consider including associated skills to make them more impressive. While the manager may know of your certification, listing the skills you learned while obtaining it can make your resume more convincing. It helps the hiring manager determine how you can add value to their organization. In addition, you may review the job description to know what skills to prioritize in this list. Include the associated skills after the name of the issuing authority.

Related:

Here is a sample of a certification section in a resume:

Certifications

-

Project Management Professional – Project Management Institute Relevant skills include project life cycle management, leadership, and effective communication.

-

Certified Scrum Master – The Scrum Institute Relevant skills include scrum and agile methodologies, lean methodology, and project management.

If your certifications are in progress, you may include them like this:

-

First Aid and CPR Certification – Canadian Red Cross – Regina, SaskatchewanExpected date of completion – June 2021

-

Chartered Financial Analyst – CFA InstituteCompleted two levels of three. Expected date of completion: November 2021.

Please note that none of the companies mentioned in this article are affiliated with Indeed.

Prepare A Summary Statement

Have you worked as a certified public accountant for a long time? Then stick to the resume summary.

For experienced accountants, the summary statement is ideal for CPA resumes.

Tons of work experience in the industry such as audits, financial statements, and tax returns followed by an accountant resume summary will boost your resume.

This heading statement will highlight your financial talents, accounting ability, and overall CPA history.

To properly get your idea across, provide numerical bullets to enlist achievements.

Recommended Reading: What To Put On An Acting Resume With No Experience

Write An Excellent Accounting Resume In 2 Steps

If you are a certified public accountant , you will most likely already have a good deal of job experience as an accountant by the time you write your first resume identifying yourself as such.

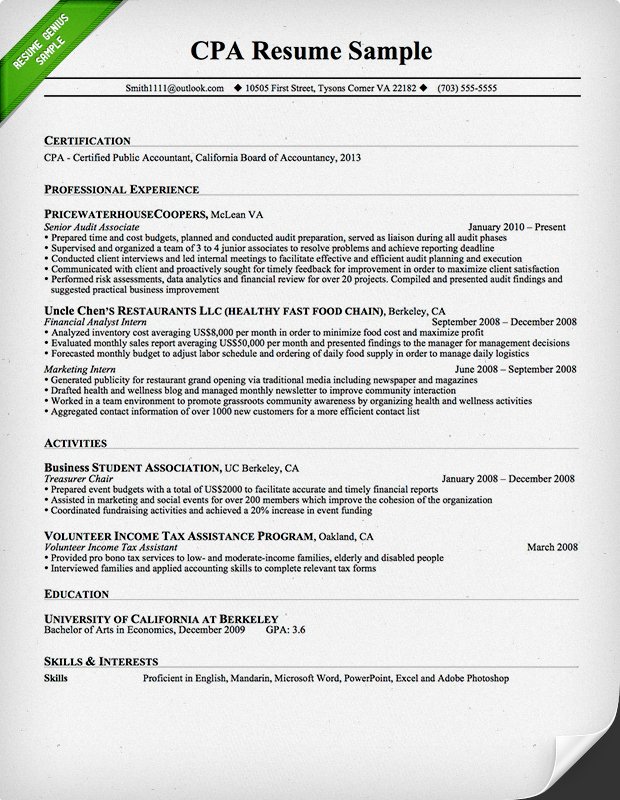

The resume above is a good example of how to leverage that experience to get that bigger, better job you want. Lets examine some of the particulars:

Include Your Certifications In Your Education Section

As their job title suggests, Certified Public Accountants typically have specialty certification that qualifies them for advanced work. The most common certification for these accountants to pursue is the CPA certification from the American Institute of Certified Public Accountants . To include this credential on your resume, you can add the certification to your education section directly above your college degrees. This can allow employers to view all of your credentials in one place.

Please note that none of the companies or certifications mentioned in this article are affiliated with Indeed.

Related:

Read Also: Resume Font Size And Style

List The Prospective Earn Date

If you are working on a specific certification program in progress, you can still list it under your certification section. Be sure to include the date you expect to be certified and how far along in the process you are currently. This is common for more extended certification programs that may take several years to earn.

Put Your Key Accounting Skills In A Resume Summary

Your resume summary is the first part of your resume employers see. Put your most impressive skills in this 23 sentence introduction to grab the hiring managers attention and increase the chances that theyll read all of your qualifications.

Unsure whether your summary should feature your accounting certifications or highlight the amount of money your accounting decisions saved? Follow these 4 steps to decide which skills to put in your summary:

Adding skills from the job ad is essential because many companies use applicant tracking systems to filter applications based on keywords from the job description.

Heres an example of a resume summary that showcases accounting skills:

Also Check: How To List Gpa On Resume

Provide Details On The Associated Skills

Suppose the skills related to the certification are relevant to the position, and you have room on your resume. In that case, you can include a list of specific skills associated with the designation. This can help to explain the relevance of the certification to the position you’re applying for and answer any questions the hiring manager may have.

Enhance Your Cpa Work Experience With Hard Numbers

Youre already a certified expert with numbers, so use this skill to your advantage by including hard numbers throughout your resume.

Hard numbers provide context for hiring managers and show the scope of your resume achievements. Try quantifying your CPA resume with hard numbers by listing the:

- number of people you supervised or trained

- size of the budgets you worked with

- number of new customers you brought in

- percentages or dollar amounts in increased funding or investments you brought about

Weve bolded the hard numbers in our CPA resume example below to show you what quantifying a work experience section looks like:

Supervise and organize a team of 36 junior associates to resolve problems and achieve reporting deadline

Analyzed inventory costs averaging $8,000 per month to minimize food costs and maximize profits

Coordinated fundraising activities and achieved a 20% increase in event funding

Dont forget to place resume action verbs at the start of your bullet points. Action verbs like analyzed, supervised, and coordinated make your CPA resume more impactful because they portray you as a leader and also provide relevant details to hiring managers.

You May Like: What To Say When Sending Resume Via Email

Nail The Objective Statement

Your prospective new employer is less interested in what you hope to get from them than what you can do for them. If you want to catch their attention with your resume objective statement, it should reflect that. Lets look at the example above sentence-by-sentence:

Licensed Certified Public Accountant with over 6 years of experience.

Since several states are still in the two-tier system of CPA licensing, it is good to reassure the employer that you are a licensed CPA rather than just someone who passed the Uniform CPA Exam and got certified to do accounting work.

It is also a good idea to let the employer know what amount of experience you have. More about this in 2.

Member of the AICPA and NYSSCPA seeking to apply diverse accounting and administrative knowledge as a supervising accountant at your company.

This second sentence identifies several strong qualifications to the employer. Membership in the AICPA or state CPA association for your particular state strongly suggests your reputability and integrity as an accountant. If you are not a member of such an association, consider becoming one.

This sentence also mentions administrative experience, which makes the candidate stand out for the specific position being applied for.

Possess a B.S. in Accounting from a top-50 accounting school.

As a CPA you will have to have had at least one year of college in addition to the four your bachelors degree required.

What Are Examples Of Strong Accounting Accomplishments I Can Include On My Resume

- Saving money: Explain how your accounting methods helped reduce accounting error rates and resulted in savings for the organization.

- Revenue: Explain the extent to which your work helped your company generate revenue. List the value of assets you oversaw and the amount of money under your care.

- Regulatory compliance: How did your interpretation of accounting rules help your company stay compliant and save money in fines and fees?

- Vendor and client relations: State the number of individual client accounts that you handled and the period that you retained them. Explain how you assessed vendors and handled their invoices.

- Management: Mention the number of junior accountants that you mentored and how you liaised with senior executives to achieve the companys vision.

Recommended Reading: How To Upload Resume To Common App

Should I Put My Cpa License Number On My Resume

Yes, you should put your CPA license on your resume in either your name title or in the profile summary, in addition to including it in the education or certification section of your resume. Regardless of where it is added, we recommend supplementing the title by including core skills and experience related to working as a CPA.

The simplest and most transparent way to demonstrate your CPA status on your resume is by putting the letters “CPA” after your name at the top of your resume. This lets the hiring manager immediately know that you are a qualified candidate.

You can also mention it in your profile summary, along with your location and number of years of experience. For example, “Certified Public Accountant with over four years of experience in public accounting and financial auditing.”

In addition to mentioning your CPA status at the start of your resume, it is a good idea to then include it again in either the education or in its own ‘certification’ section. Either location, you should include information alongside, such as what state it was issued and maybe the year it was issued. “For example, ‘Florida State Licensed Certified Public Accountant , 2019’.

Supv Cparesume Examples & Samples

- QC/QI: Maintains: QA program. Monitors work being performed. Evaluates processes and works to improve using the Lean principles

- Documentation: Working with the Core Lab Manager, maintains employee attendance and other records. Monitors and documents the orientation and training of all new employees and annual competency of existing employees. Records concerns from physicians and office staff for QI trending

- Special Duties: Prepares procedures for processing area, investigates special requirements for referral testing, monitors staff performance, vacation requests and daily assignments. Attends meetings. Assures adequate supplies for specimen referrals. Markets services as needed

- Actively directs, oversees and guides central processing area staff in providing great customer service

- MT or MLT required and completion of a Bachelors or Associates Degree in related field

- Minimum of two years Client Services experience required and supervisory experience preferred

Recommended Reading: Where To Print Documents Nyc

Accountant Resume Examples That Worked In 2022

A business is only as valuable as it can demonstrate in its financial statements. Accountants are the foundation upon which all successful organizations are built.

To be a successful accountant you need to diligent, organized, and an expert with numbers and financials.

You shouldn’t also need a completely separate skillset in resume writing to demonstrate this to an employer.

That’s where this guide comes in. At BeamJobs we’ve reviewed 850 accountant resumes and have thoroughly distilled what works, and what doesn’t, across these resumes.

We’ve chosen the 5 best accountant resume examples and made them editable, or you can take advantage of our free resume builder, so you can land your next job in 2022.

Why this resume works

- This resume is easy to read while also conveying a lot of information about this accountant’s qualifications and experiences. When it comes to your resume template and resume format, keep it simple. Before a human looks at your resume a computer will so avoid any fancy images or graphics that might be hard for software to parse.

- The resume objective is a great introduction to what the rest of the resume highlights. It quickly touches on this person’s qualifications and also explicitly states what they’re looking for in their next accounting role.

- When you document your past work experience, you should state your experience in reverse chronological order. That is, start with your most recent experience and work backwards.

Tailor Your Resume For The Cpa Job

CPAs are needed in a wide variety of industries and businesses. Consequently, CPA job postings have different requirements and specifications.

Make sure you include the skills or qualifications the hiring manager is looking for in your certified public accountant resume.

Note: A certified public accountant resume is slightly different from a certified public accountant CV as it will be made to fit a specific CPA role.

You May Like: How To Say Stay At Home Mom On Resume

In Your Education Section

You may have a certification that you obtained while in school and isn’t directly related to the role. If the certification confers a useful or transferrable skill, you may include it in the education section. You can do this by creating a bulleted list after the name of your institution and including the name of the certification. Remember to include the name of the issuing authority and the date you received it.

Example:

-

SkillUP Training Insitute, Toronto, Ontario

Include Your Work History

Your work history is an essential part of your resume, even if you have yet to work as a CPA. Including your work history allows a recruiting manager to learn where and when you developed your skills, how long you’ve practised as a CPA, if applicable, and which previous roles may relate to your CPA abilities. The work history section typically includes the title of the position you held, the name of the company that hired you and your employment dates. It then lists your key responsibilities in that role.

Recommended Reading: Should You Include Your Gpa On Your Resume

Project Management Certifications For Your Resume:

When it comes to certificates for Project Managers they are always a plus.

They show that youve invested lots of time to boost your career and learn new skills. And that you also wanted to get better knowledge for your work.

If your certificates are from trusted organizations. If they vouch for you, its a good thing for the Hiring Manager to trust them.

What are the best project management certificates to feature on your resume?

You can see our Top 10 list:

More on the topic of a perfect Sales resume see here.

Cpa Duties And Responsibilities

To accomplish their goal of managing a corporation’s or individual’s tax and financial information, a CPA performs various tasks. After analyzing several job listings, we have identified these main CPA duties and responsibilities.

Prepare Tax Returns Preparing and filing federal, state and local income tax forms are among the chief tasks of a CPA. This includes the analysis of tax and financial planning information. They would consult with companies or individuals to review client-specific information and ensure that all information is being presented and filed properly. A CPA will interpret relevant tax laws and ensure that tax returns are completed according to federal and state regulations.

Assist with Financial Planning A CPA can help corporations review financial planning activities and prepare financial statements for assets and payroll. Reviewing retirement plans and compensation and benefits packages, completing shareholder reports, assisting with budget management and preparing W-2’s, 1099s and other relevant forms are all responsibilities that fall to a CPA.

Oversee Audits It is mainly the duty of a CPA to ensure that all financial and tax records and reports are adequately prepared for an audit. A CPA can review financial information and create audit reports. In addition, a CPA can advise a corporation or individual being audited by the IRS.

Recommended Reading: Email Resume To Hiring Manager