Actuarial Analyst Resume Samples

The job of Actuarial Analyst is challenging and requires hands-on experience in the fields of insurance and investment sectors. The role demands exclusive educational qualification in subjects like finance, law or insurance. The Actuarial Analyst Resume should include the key skills of finance expertise, analytical thinking, risk management techniques, managerial skills, team player and, communication skills. A professional Actuarial Analyst provides customized risk management and risk financing solutions to their customers.

The job responsibilities of a typical Actuarial Analyst are analyzing all the risk factors of an investment plan and helping customers in the management of such risks. They analyze the risks arising due to uncertainty and variability of the investment returns to feed the investment decisions of the customers. Follow our objectives and sample resume to draft your profile that should encompass the required key skills and responsibilities of an Actuarial Analyst.

Responsibilities For Employee Health & Benefits Actuarial Intern Resume

- Some knowledge of programming or data retrieval packages, such as SAS or SQL

- Assist in preparation of actuarial valuation and compliance work primarily for US Defined Benefit Retirement Plans, including

- Prepare benefit coding to replicate valuations under legacy tools

- Support the data management process including but not limited to

- Assist in other reporting activities and ad hoc projects

- Assist actuaries in developing rate or reserve indications and evaluations

- College Sophomores and Juniors

- Sophomore or Junior majoring in Actuarial Science, Math or Statistics

- Develop technical expertise and be an active participant in consulting projects

What You Really Need To Get Your Actuarial Dream Job

An internship isnt necessary!

What you really need are the TECHNICAL SKILLS, ACTUARIAL KNOWLEDGE, and REAL-WORLD, RELEVANT EXPERIENCE that is naturally gained while in an internship.

Those are the qualifications, in addition to actuarial exams passed, that employers expect from you.

If an employer sees that you dont have those qualifications, thats when theyll pass on your application, and move on to the next applicant.

Now heres some really good news for you..

Read Also: Teenage Resume Skills

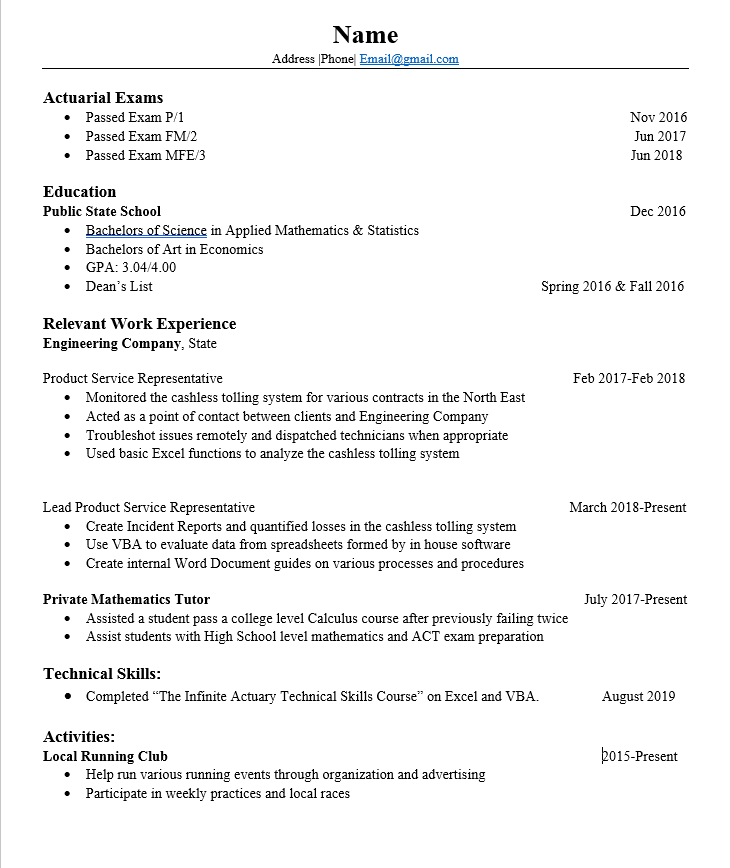

Education In The Actuarial Resume

With any employer in the business and finance field, a college degree or higher is highly valued and respected. Hence, with actuary jobs its crucial you highlight your university degree in the actuary resume.

But how does one go about showing their educational background and academic expertise in a resume? The answer is simple youll need to include an education section in your actuary resume example.

Want More Help With Your Journey

Let us know in the comments below Which one of these principles do you think would be the best for you to focus on for the next month?

You May Like: Email Message When Sending Resume

Is An Actuarial Analyst An Actuary

No, an actuarial analyst is not an actuary. A person does not become an actuary until they have taken the right exams and become fully credentialed. An actuarial analyst is working to be an actuary but has not completed all of the exams required for certification.

An actuarial analyst is just the job title of someone working as an actuary but isn’t yet a fully qualified actuary. An actuarial analyst is a great starting position for someone interested in becoming an actuary but still needs the experience and time to pass the many exams.

An actuarial analyst uses statistics, probability, and economic concepts to help a company leverage its financial risks and potential rewards. Moving from an actuarial analyst position to an actuary requires passing a series of 10 professional examinations needed for the full qualification.

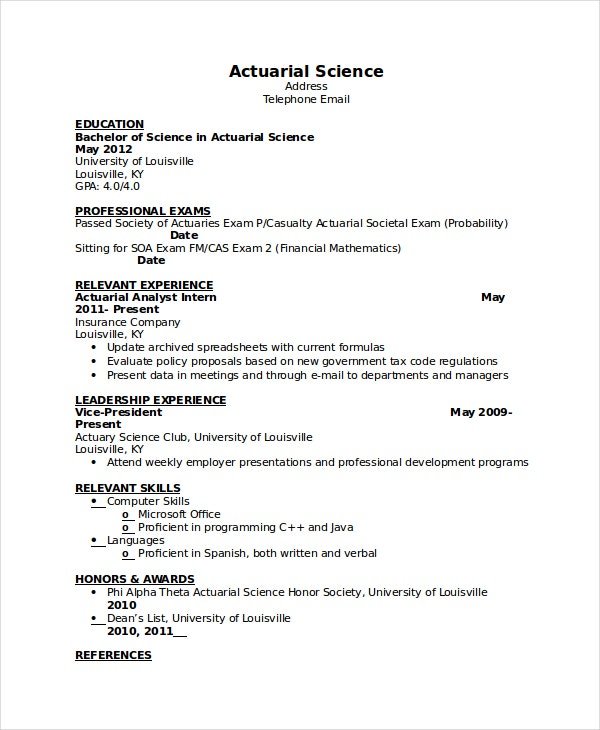

How To Display Your Exams

Im going to give you a sneak peak at the sample resume that I provide in my actuarial resume building course. Heres the exams section:

See how this sample resume clearly displays the exam name, the fact that the applicant has passed, and the month/year of passing? You should do exactly the same thing. Dont stray from this setup! Its clear and provides employers with all the information that they need.

You may have also noticed that it includes the next exam that the candidate plans to write, along with the month/year that theyre planning to do so. Again, you should do the same thing. This shows employers that youre still working hard and being proactive in your actuarial career pursuit. Ideally, the month that you plan to write your next exam should be no more than 8 months into the future. Less than 6 would be ideal though.

Also Check: Excel Skills On Resume

How Long Does It Take To Become An Actuary

It depends on your goals and the amount of time you dedicate to preparing for exams. For instance, it generally takes three to five years to complete the educational and testing requirements to get an entry-level job. However, it can take up to 10 years to become a fully qualified actuary. Many actuaries aim for associate status within five years.

Responsibilities For Marketplace Summer Actuarial Intern Resume

- Actively pursuing SOA exams toward actuarial certification

- 5) Provide data and analysis to assist in evaluating the impact of proposed benefit, system or process changes

- Participate in weekly training sessions

- Data collection from various sources to gather insights into new and emerging risks in collaboration with the Incubator actuary

- Collaborate with actuaries to analyze data and produce exhibits for pricing property and casualty insurance

You May Like: Samples Of Narrative Resume

Skills For P& c Actuarial Intern Resume

- Energetic with good teamwork skills

- Demonstrated skills in MS Office Professional, with a high proficiency in MS Access and MS Excel highly desirable

- Strong PC skills with proficiency in EXCEL and ACCESS

- Strong mathematical skills essential

- Strong written, oral and interpersonal skills required

- Strong mathematical and analytic skills

- Proven technical and analytical abilities, leadership potential, innovation, creativity and superb communication skills

- C# or any object-oriented programming skills

- Develops underwriting skills for use in self-insured projections and fully-insured renewals

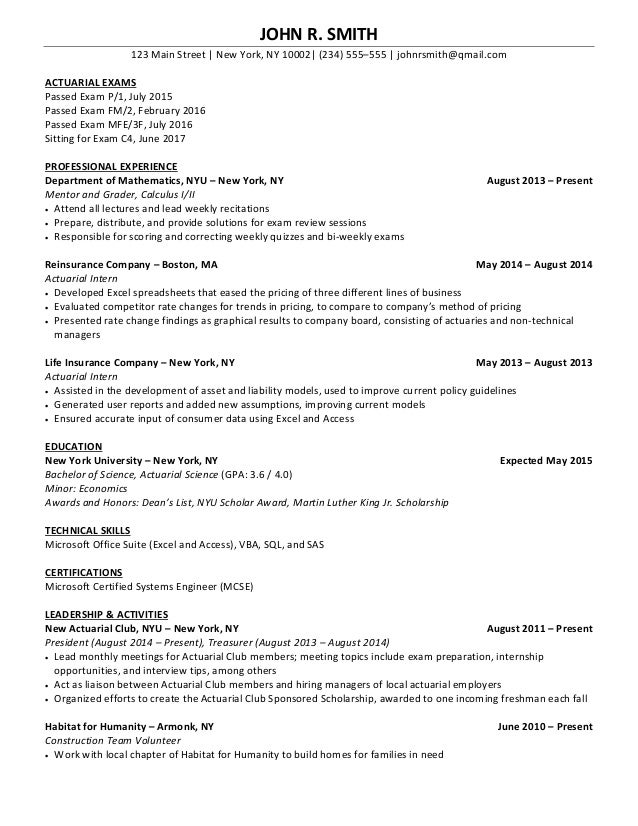

Describe Your Professional Experiences On Your Actuary Resume

Lets get started with writing a strong, comprehensive experience section that the hiring manager is going to love!

The purpose of this section is to describe the duties and obligations you faced at your current or previously held job. Make sure that all of the work histories youll be including stays relevant to the job posting youre applying for!

Please include the job title above the company name, employment dates, and job description. Make sure the job title is in bold font as well.

If youre having trouble writing the experience section and want to look at an actuary resume example, then check out our resume builder examples.

Read Also: How To Say You Are Bilingual In A Resume

Computer Skills And Certifications For Actuaries

As an actuary, youll frequently be working with programs such as Excel, PowerPoint for your reporting and trend analysis.

Moreover, youll need to possess statistical techniques and the ability to work with more senior members of staff.

A great way to show the hiring managers that youre up for the task is by including a certification section in your actuarial resume.

Certificates are an excellent way of gaining additional training for the actuarial position and becoming a more experienced pro in the field. The recruiters love certificates too!

A useful certification for actuaries is the Associate of the Society of Actuaries certification.

Retirement Summer Actuarial Internresume Examples & Samples

- Analyze client data to track historical and future employment trends and their correlation to retirement benefit programs and funding

- Use state-of-the-art software and stochastic modeling tools to calculate clients financial measurement of their retirement benefit programs

- Assist senior consultants as they strategize with clients to develop/enhance their retirement benefit programs

- Review and share updated regulations and or legislated changes that affect clients ongoing administration of their retirement benefit programs

- Fully matriculated student with Junior Class standing progressing towards a bachelors degree in actuarial science, math, statistics, economics, finance or another related field

- Minimum GPA of 3.0/4.0

- Availability to work 10 consecutive weeks during the summer

- Superior analytical and mathematical skills with a strong work ethic

- Microsoft proficiency with a strong command of Excel

- A commitment to achieving Society of Actuaries designation

- Excellent interpersonal, verbal and written communication skills

You May Like: Replace Resume On Linkedin

The Actuary Accelerator Community

A 5-Phase Actuarial Career Plan & Networking Community

Learn EVERYTHINGyou need to know to become a top actuarial candidate that gets interviews and job offers, no matter what undergrad degree you have or are pursuing.

Impress employers by talking about REAL ACTUARIAL-BASED PROJECTS that youve completed on your own.

Maintain a good WORK-LIFE BALANCE and SAVE TIME by using our step-by-step plan and resources that get you job-ready in just 2-3 hours per day.

Make FASTERprogress and stay MOTIVATEDby studying for exams with other members of the community. You wont feel like youre doing this alone anymore.

Get CLARITYon whats most important, so you can ELIMINATEthe overwhelm and exhaustion that future actuaries often feel throughout this journey.

Actuary Careers Boast Enormous Projected Job Growth Plus A Six

Actuaries are the oracles of the financial world.

Do you have a knack for analyzing and solving problems? Are you business oriented, self-motivated, and a math whiz? Learn how to become an actuary and put your skills to work.

A career as an actuary comes with several challenges and rewards. There are vast opportunities to grow and work within a number of industries. In fact, the Bureau of Labor Statistics projects a whopping 18% increase in new actuary jobs by 2029. Oh, and the six-figure salary isnt too bad, either.

But the road ahead isnt a cakewalk. It takes hard work and dedication to pursue and maintain an actuarial career. Read on for better understanding of an actuarys job duties and requirements, plus available job opportunities in this in-demand field.

Also Check: Where Is The Corvette Factory

Manager / Director Actuarial Servicesresume Examples & Samples

- Direct and manage staff level personnel in the execution of audit support and advisory projects for property and casualty engagements

- Provide technical support to the Actuarial Management group

- Develop and review KPMG and client workpapers and analytics

- Maintain documentation files consistent with KPMG workpaper requirements

- Assist with project planning, development of deliverables, and other technical writing exercises and lead selected business development efforts

- Support business development efforts for secondary target clients

- Seven years of work experience in actuarial modeling working with actuarial software and applicable recent work experience in a professional services environment

- Certification as an Associate of the Casualty Actuarial Society and Member of the American Academy of Actuaries

- Strong technical writing and verbal communication skills

- Strong understanding of property and casualty insurance products

- Ten years of work experience in actuarial modeling working with actuarial software and applicable recent work experience in a professional services environment

- Certification as a Fellow of the Casualty Actuarial Society

- Exposure to International Financial Reporting Standards and demonstrated work experience is a plus

- Exposure to Predictive Modeling and demonstrated work experience is a plus

Which Is An Example Of An Actuary Resume

Actuary Resume Examples Actuaries are finance experts responsible for assessing financial risks and advising their clients. Usual duties listed on an Actuary resume example include analyzing data, preparing reports, advising on various business aspects, collaborating with other professionals, and implementing the requirements of regulatory bodies.

Recommended Reading: Excel Skills For Resume

Broaching The Subject Of Professional Behavior

As I was walking down the row of cubicles late Friday afternoon, thinking about the glorious weekend ahead, I saw that another student actuary at Excellent & Reliable Insurance Co. had lingered at his desk after quitting time.

Hey, Joey, you need to pack up and go instead of staring at a blank computer monitor, I said.

Oh, Im just thinking about something, he said.

Well, lets think about it at a table outside the Golden Ale microbrewery, while sipping a couple of cold ones.

We headed down to the corner, sat down, and got our drinkslemonade for Joey I had forgotten he was not a drinker.

So, whats on your mind on this beautiful day? You really look gloomy, I said.

No, Im not gloomy, I just am not sure how to handle a situation. Its about Martha.

Joey explained that he had accidentally seen a copy of Marthas résumé that she had left in a copy machine, and it stated that she had managed a group of four other actuaries doing the pricing and product development for the new triple-tiered bonus-fixed indexed annuity product.

She wasnt the project manager Mark was. She just did one piece of the model for the new product. Although shes been here for nine years, shes just an associate. Mark is a fellow with 12 years experience.

Whoa, buddy, I said. That is not good. Have you talked to her about it?

Yeah, hell surely notice that, I agreed. Maybe you shouldnt talk to him about the other people, even if you just have good things to say about them.

The Financial Mathematics Exam

- Study Materials: The ASM Study Manual for the FM/2 Exam is extremely thorough and covers all topics on the exam. It contains hundreds of practice problems as well as five full-length practice exams.

- Calculators: The BA II Plus is a financial calculator has all of the capabilities needed for the FM/2 exam, but it has an inferior display. The screen does not display operations entered and by default does not follow order of operations. It will save you time for many financial calculations, but you may wish to use the TI-30X, which has a two-line display and superior algebraic capabilities, for other problems. You can bring two calculators to the exam.

Don’t Miss: How To Get Your Resume Noticed On Indeed

Taking And Passing The Actuarial Exams

Actuarial Associate / Igloo Modelerresume Examples & Samples

- Manage and lead various capital model build, implementation and validation using igloo programming

- Implement and maintain igloo models to comply with accounting and internal business requirements

- Monitor Igloo model build project life cycle to ensure accuracy and timeliness

- Maintain and update the Igloo model documentation for governance

- Manage communications with the team for the explanation of the changes in the igloo models

- Preparation and review of igloo model input templates for the AIG PC CCAR stress test

- Manage and coordinate in the development of Data Integration Tool via which model input templates are uploaded to Igloo models

- Manage communications with the team and assist them in Igloo model set up, resolving igloo model queries and execute igloo runs

- Review and assist in the preparation of mapping tables to apply legal entity specific accounting treatment to AIG asset data

- Create Reconciliation and matching reports for

- Set-up validation templates for the business to review Igloo model outputs

- Perform continuous assessment of the Igloo models process and process re-engineering to reduce the timing of the model runs

Also Check: Corvette Tour

Director Actuarial Documentationresume Examples & Samples

- Managing and coordinating the process for developing and maintaining actuarial model information, as documented in memos, SOPs, manuals, procedures, calculations, business specifications, and other forms of communication

- Write, edit, and manage documents that describe the current state of each system

- Lead effort to develop/maintain document templates

- Gather information to create new and clean up existing current-state system documentation by

Skills For Retirement Summer Actuarial Intern Resume

- Communicate effectively through a variety of media

- Established presentation skills, both verbal and written

- Computer skills with proficiency in Excel and Word

- Communicate complex analyses effectively

- Demonstrated leadership experience with a drive for results

- Basic project management and people skills

Don’t Miss: How To List Presentations On Resume