Skills For Loan Officer Associate Resume

- Approval authorization, credit union, and finance company experience

- Solid knowledge of title insurance,tax deferred exchanges, and real property law

- Strong advisory and customer service abilities

- Able to consistently demonstrate discipline and focus

- Demonstrated proficiency and expertise with personal computers and Microsoft applications or similar software

- Substantial experience required in business credit & debt service analysis

- Economic development/business development experience helpful

- Three years of significant origination experience in the consumer mortgage and home equity business

Experience For Mortgage Loan Officer Credit Union Resume

- Bi-lingual English/Spanish

- Mortgage banking.

- Assists the high-producing loan officer in the timely submission of complete loan application files. Enhances loan officer productivity

- Coordinates and proactively communicates with processing site, operations sites, customers and loan officers to ensure a smooth loan application process

- Meet regularly with Mortgage Banker to keep communication on loan files and marketing current

- Gather all referral partner information and enter in Loan Tool Box which is the referral partner and customer marketing retention software

- Organizes and leads productive marketing activities

Mortgage Closing Specialistresume Examples & Samples

- Prepare required closing documents using document prep and loan origination systems. 100% accuracy in following bank policies/standards, departmental procedures meeting and regulatory closing requirements

- Accurately document receipt of files, missing information, service level results, delivery of loan closing packages

- Reviews and Approves Settlement Statements and Loan Approval to authorize closing of loan transactions meeting RBC Bank policy regulatory requirements. 100% accuracy is expected

- Wire funds accurately and timely to meet deadlines for all closings following office procedures and RBC policy

- Meets communication standard set for department to insure positive customer experiences for all parties to include: Cross Border Mortgage Advisors, Customers, Team Members, Mortgage Processor Specialists, and Support Departments

- Meets or exceeds stated SLA on a consistent basis

- Executes Giant Standards and Client Rules as defined by RBC Bank

- 100% compliance is required

- Annual certifications obtained from RBC Campus

- Minimum 2-3 years Mortgage Closing Experience

You May Like: How To Add Babysitting To Resume

Skills For Real Estate Loan Officer Resume

- Conduct credit investigations and provide lending advice to locations, managers and sales staff

- Mitigate risk by reviewing CHS Capitol and other loan guarantees. Coordinate approvals on CHS guaranteed loans

- Administer and coordinate specially assigned extended credit programs to maximize sales while still managing risk appropriately

- Monitor accounts and perform collection calls and communication on an ongoing basis

- Ensure that locations are administering policies and procedures as directed

Next Create A Commercial Loan Officer Skills Section On Your Resume

Your resume’s skills section should include the most important keywords from the job description, as long as you actually have those skills. If you haven’t started your job search yet, you can look over resumes to get an idea of what skills are the most important.

Here are some tips to keep in mind when writing your resume’s skills section:

- Include 6-12 skills, in bullet point form

- List mostly hard skills soft skills are hard to test

- Emphasize the skills that are most important for the job

Soft skills are also valuable, as they’re highly transferable and make you a great person to work alongside, but they’re impossible to prove on a resume.

Example Of Commercial Loan Officer Skills For Resume

Don’t Miss: Do You Have To Put Your Address On A Resume

Experience For Licensed Loan Officer Resume

- Makes sales calls on prospective borrowers, real estate agents, developers and other business partners to market the companys financing solutions

- Represents the Bank at various networking functions to further the Banks reputation and reach in the community

- Follow up with leads and applicants to stay connected and keep the loan process moving forward

- Assist real estate agents with loan terms for drafting offers

- Manage the loan approval process from deal screening to loan approval

- Assist with the marketing and communication on closed transactions

- Participate in strategic planning and innovation process

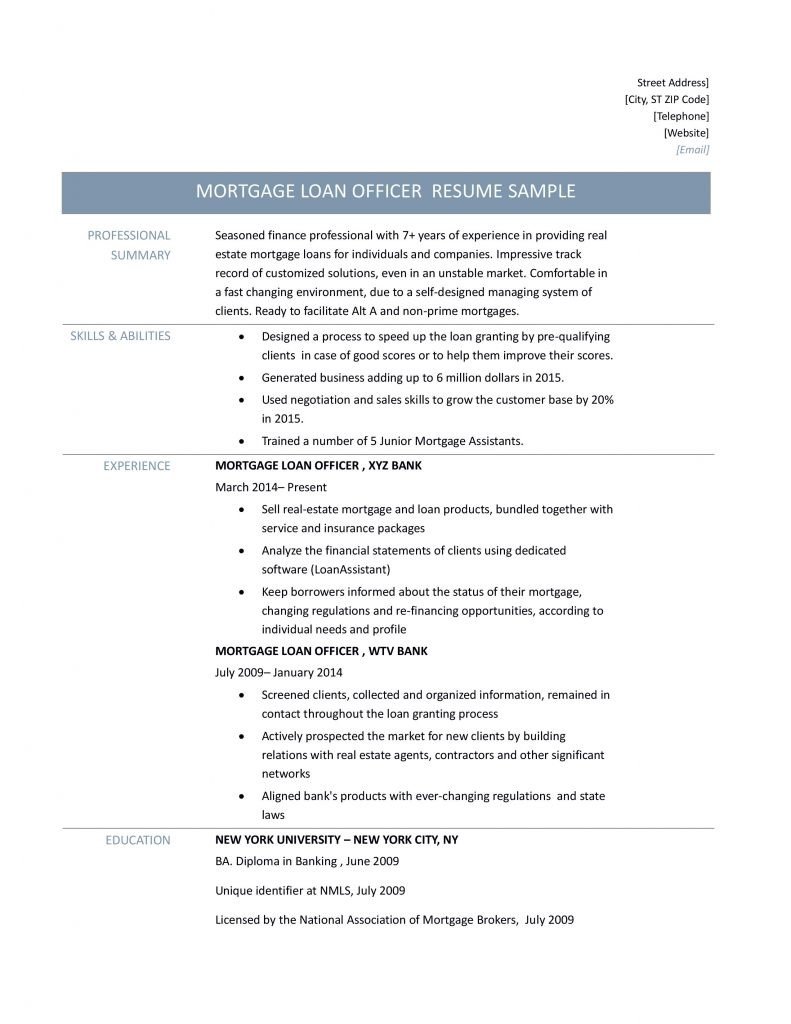

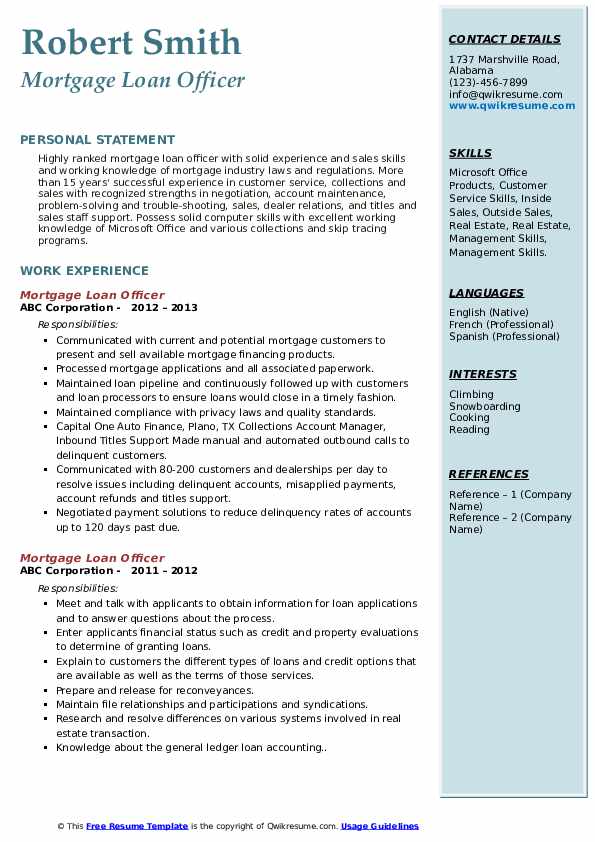

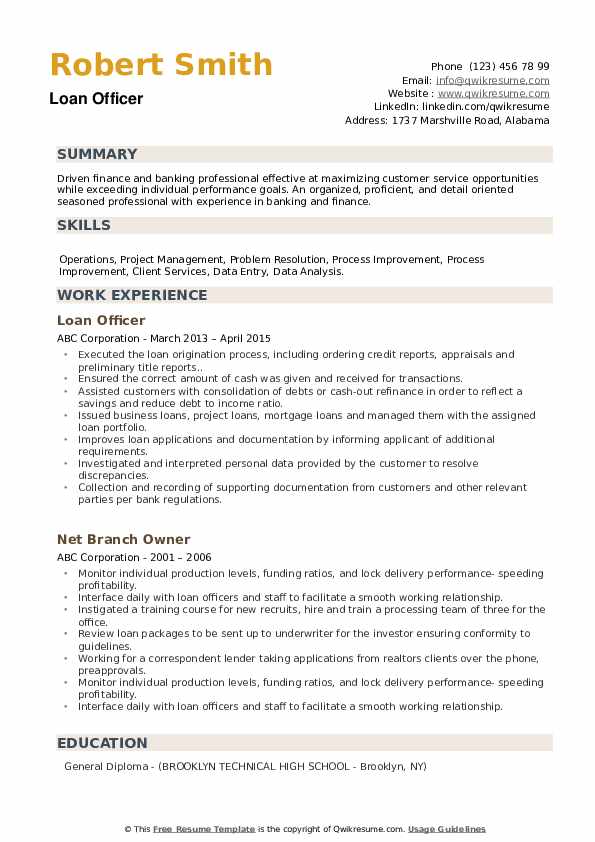

Resume Summary Example: Lend An Air Of Confidence

The summary of your loan officer resume should confidently present your value as an employee. You have about four lines, to describe your customer service style and career standing. The main idea of this section is to sell your prospective employer on what you can do for them.

A great example to include in your summary, or profile, is the data pointing to your increase in good loans or, conversely, how you reduced unpaid loans. Although recruiters are more likely to look at your most recent position first, if they are sold on your experience, they will scan up to the top to read your profile.

Our summary resume sample below is a good guide, but if you want more ideas for this section â the only one using complete sentences â see our related banking and finance resume examples. We offer a general banker resume sample and a loan process resume example. If you are looking for career advancement ideas, try our financial analyst resume sample or our financial advisor resume sample.

Experienced and attentive Loan Officer with several years of experience providing excellent customer service to clients seeking loans. Adept at thoroughly analyzing the financial status of clients and helping them to apply for and obtain the best loans for their lifestyle. Bringing forth a track record of increasing client satisfaction ratings, while working in accordance with all company policies. Ambitious and driven to reach new levels of success.

Also Check: How To Make A Resume With No Previous Job Experience

Experience For Mortgage Loan Officer Iv Resume

- An existing book of business from external sources

- General understanding and knowledge of financial services products

- Extensive knowledge of Microsoft office software, including Word, Excel, Power Point

- Thorough understanding of the local real estate market and the mortgage industry

- Thorough knowledge of mortgage lending requirements, regulations and procedures for FHA, VA and conventional loan programs

- Possesses advanced technical knowledge and understanding of business tax returns, trusts, LLCs, and other asset protection tools used by high net worth clients

Experience For Loan Officer Affinity Resume

- Able to problem solve, by independently researching and assessing options and resources

- Takes complete and accurate loan applications resulting in quick approvals

- Make a lot of money resulting in a happy family/exciting adventurous life

- Assists in developing and administering the SBA Loans

- Applies transaction-appropriate pricing in accordance with company guidelines and pricing policy

- +Processing Opening Demand Deposit Account , Loan Disbursement of Personal Loan, notification to customers included

Also Check: What Can A Cover Letter Explain That A Résumé Cannot

M& t Rcc Mortgage Administratorresume Examples & Samples

- Review of closing packages to insure completeness, accuracy, and confirm transaction flow

- Evaluation of transactions to determine appropriate accounts affected

- Reconciliation of daily activity and balances to various system reports

- Position must be able to analyze variances and determine the source and solution for the variance. Incumbent must be able to determine the appropriate action to resolve any variances and correct the various systems

- Provide back-up support to the daily work flow desk for wire transfers, DDA moves, deposits, and writing checks

- Position must be able to work independently under the time pressures and also be able to work as a part of a team

- Incumbent will perform other duties and special projects as assigned by management

Mortgageresume Examples & Samples

- Excellent communication and interpersonal skills, and be able to effectively tailor communications to a diverse range of business and technical stakeholder groups

- Have the ability to work well under pressure to provide timely and accurate solutions to business opportunities and challenges

- Be a self-starter that can work well both independently and as a team. Evidence of developing effective working relationships with team members, senior management and external parties required

- Minimum of six years proven and progressive experience in area

- Proven reporting skills including strong knowledge of Excel

- Working knowledge of the mortgage process including pricing, registration, processing, underwriting and closing or equivalent

- Ability to work independently and also engage with Sales Management Team on pipeline health and loan level escalationssupported or equivalent

- Strong project management, communications, analytical, organizational and planning skills

- In-depth knowledge of Group or Department supported, including technology

Read Also: How To Write Basic Knowledge In Resume

Skills For Outside Loan Officer Resume

- CRA Retail Mortgage Lending Experience is Required

- Excellent benefits including

- Experience working on a power team

- An ability to prioritize multiple competing tasks

- Manage pipeline with good attention to detail

- Experience that includes a combination of governmental accounting/finance, loan origination, public finance, or business administration

- Recent mortgage origination experience

- Intermittent supervision required, depending on experience

Write An Impressive Resume Summary

Did you know resumes are only looked at for approximately 6-7 seconds? Including a resume summary at the top of your resume may be what takes your resume and chances of getting hired to the next level.A resume summary is a 1-2 sentence blurb that summarizes everything your resume consists of. Including this really shows hiring managers that you respect their time.

Tip: Sometimes, it’s easier to write your resume summary after you have already written your resume. That way, it’s easier to pick and choose what you want to include.

Here are some things to mention in your resume summary:

- Years of experience

- Career achievements

Here’s an example of what your resume summary can look like:Licensed and organized mortgage loan officer with 5+ years of experience in managing heavy pipelines of 50+ loans and exceeding sales targets. Looking to become a market leader through customer service and cutting-edge financial solutions.ââ¬ï¿½

Tip: Include an objective in your resume summary to give it that extra kick.

Here’s what your resume summary should not look like:Mortgage loan officer with 5 years experience in managing mortgage loans.See? It just doesn’t have the same feel to it.Need more help writing a professional resume summary? Our guide on writing resume summaries has tons of examples.

Also Check: How To View My Resume On Indeed

How To Write A Mortgage Loan Officer Resume

Heres how to write a mortgage loan officer resume of your own.

Write Compelling Bullet Points

Bullet points are the most effective way to showcase your experience and qualifications. But rather than simply listing your responsibilities, you can make your bullet points much more interesting and compelling by using specific numbers and metrics.

For example, rather than saying you managed accounts, you could say that you managed accounts for 15+ mortgage brokers, providing guidance on loan submissions and ensuring timely and accurate submissions to lenders.

The second bullet point is much more specific and provides a clear sense of the scale of the project. It also provides a clear sense of your role in the project and what you did to contribute to its success.

Related:What Is a Mortgage Loan Officer? How to Become One

Identify and Include Relevant Keywords

When you submit your resume online, its likely that it will be scanned by an applicant tracking system for certain keywords. The ATS looks for certain keywords that are relevant to the job opening in order to determine whether or not you are a good fit. If your resume doesnt have enough of the right keywords, your application might not even make it to a human recruiter.

To increase your chances of getting noticed, use this list of mortgage loan officer keywords as a starting point to help you identify the skills and experience that are most important for the role:

- Mortgage Lending

Create Easy-to Scan Sections

Loan Officer Resume Examples

Loan officers help both individuals and businesses obtain loans for commercial ventures and personal spending. From 2020 to 2030, the Bureau of Labor Statistics projects little to no change in employment for loan officers, about negative one percent. Despite limited job growth, there will be an expected 25,000 job openings, on average, per year over the next decade as loan officers move into new fields and exit the workforce.

Due to the limited demand for loan officers, workers entering this field need well-written resumes that effectively highlight their unique skills and qualifications. To help you put together a resume that stands out from the crowd, below, you will find four high-quality loan officer resume examples for many levels of experience. We added a few tips for improving your resume writing and advice for optimizing your resume for specific job descriptions.

Recommended Reading: When To Take Off High School On Resume

Senior Mortgage Loan Officer Resume Samples

A Senior Mortgage Loan Officer is hired to evaluate, authorize, and recommend approval of real estate, commercial or credit loans. The job description entails advising borrowers on financial status and methods of payments. Summary of duties seen on the Senior Mortgage Loan Officer Resume includes the following approving loans within the specified limits meeting applicants to gather the needed information analyzing applicants financial status and property evaluations to determine feasibility, explaining customers about various types of loans and credit options and computing payment schedules.

The most sought-after skills for the post include the following strong knowledge and experience in sales or real estate experience with pertaining guidelines and regulations working knowledge of mortgage applications and processing software and familiarity with using e-mail and internet. A degree may not be a mandatory requirement, however, possessing one will be useful.

Include Your Experience Level

Indicate how much professional experience you have as a mortgage loan officer. Mortgage companies or banks often hire several levels of loan officers, such as Junior and senior loan officers. Mentioning how many years you’ve worked in the mortgage industry or as a loan officer can help employers more quickly assess your qualifications for the role.

Also Check: Do’s And Don Ts On Resumes

Mortgage Loan Originator Chapel Hillresume Examples & Samples

- Follow defined protocol for escalation exceptions

- Take applicant applications by completing Fannie Mae form 1003 on the laptop

- Utilize the laptop for communication and access of daily rates, applicant credit reports, Loan Prospector responses and transmitting the loan to LOMAS

- Communicate with branches and/or applicants of providing timely updates and progress reports

- Work with assigned branch office to ensure awareness of mortgage loan products and policies

- Maintain knowledge of Fifth Third Mortgage Companys policies and procedures

- Maintain high levels of customer service while managing each applicants and support staffs expectations

- This position requires S.A.F.E. Act registration at the time of employment through the Nationwide Mortgage Licensing System . The NMLS web site provides the MU4R questions and registration required for employment in this position

Responsibilities For Wealth Management Loan Officer Resume

- Improve loan applications and documentation by informing applicant of additional requirements

- Advise the customer regarding the various mortgage loan products based on the customers individual needs

- Provide cash to closing information to NHCs for Spotlight homes on a weekly basis

- Advise and recommend to the customer regarding the various mortgage loan products based on the customers individual needs

- Responsible for originating permanent loans on stabilized MF properties for the banks portfolio

- Collect and booking the agent fee

Don’t Miss: How To Make A Resume For College Applications

Skills For Junior Loan Officer Resume

- Proficient interpersonal relations, communicative, and sales skills

- Financial statement analysis skills – Ability to analyze balance sheets and income statements to assess financial performance and creditworthiness

- Lending and sales-culture environment experience

- Lending experience in a credit union, bank or finance company

- Skill in analytical thinking and critical thinking

- Home Equity or Mortgage Lending Experience

- Prior Bank related automotive financing desired

- Consumer underwriting experience

- Two years outside sales originating mortgage loans experience

Experience For Loan Officer Cre Resume

- Demonstrated knowledge and practical experience in applying credit risk principles to lending recommendations

- Develop and deepen the the company relationship with existing and new borrowers by enhancing/creating a positive customer experience overall

- Buy side experience as a commercial real estate loan officer on a national, life insurance company lending platform

- Work closely with all lending staff to assure excellent customer service

- Lending experience

- Sends all required paperwork to client and provides excellent customer service

- Mortgage Loan Origination or Loan Officer Assistance experience required

- Consumer credit underwriting experience

- Good business relations exist with members. Members problems or questions are courteously and promptly resolved

You May Like: How To Write A Government Resume

Skills For Mortgage Loan Officer Assistant Resume

- To communicate clearly and effectively, both verbally and in writing, across a variety of audiences

- Delivering excellent customer service by focusing on customer need

- Experience demonstrating proficiency and expertise in selling and overseeing processing and closing of first mortgage and equity loans

- Experience in banking or mortgage lending origination required

- Have a good understanding of FHA, VA and conventional underwriting guidelines for all loan investors

- Residential mortgage experience, including Reverse Mortgages

Senior Mortgage Oversight Specialistresume Examples & Samples

- Minimum of six years proven and progressive mortgage default, loss mitigation, bankruptcy , forclosureor risk management experience or equivalent

- Strong knowledge of the residential mortgage servicing industry, Company policies, government regulations, investor requirements and guidelines

- Ability to exercise discretion, tactfully handle sensitive and confidential data and work independently within broad guidelines

- Proven ability to respond to changing circumstances

Don’t Miss: How To Email Recruiter Resume

Mortgage Loan Originator Assistantresume Examples & Samples

- Answer phone calls, manage calendar for MLO and appts/schedule closing appts. This duty is performed daily, about 20% of the time

- Preparing files for processing and closing-submission and resubmission. This duty is performed daily, about 20% of the time

- Ordering appraisals, title work, and credit supplements. This duty is performed daily, about 10% of the time

- Preparing withdrawals & denials. This duty is performed weekly, about 5% of the time

- Ordering TRV’s, SSN verification. This duty is performed daily, about 5% of the time

- Maintain closed loan files. This duty is performed monthly, about 10% of the time

- Obtain conditions/documents from clients for loan processing/approval. This duty is performed daily, about 10% of the time

- Complete required BSA/AML training and other compliance training as assigned. This duty is performed annually, about 5% of the time

- Perform any other related duties as required or assigned