How Does The Payment Pause Affect My Cancer Treatment Deferment

If you had been granted a cancer treatment deferment prior to the beginning of the COVID-19 payment pause,your loan was placed into the payment pause. If your cancer treatment deferment would have ended after December 31, 2022, your loans will be placed back into that deferment automatically on January 1, 2023. You will notneed to recertify your cancer treatment deferment before payments restart. The earliest you might be asked torecertify is July 1, 2023. Great Lakes will send notification of your new recertification due date before itis time to recertify.

Build Up Your Emergency Fund

Once payments resume, student loan borrowers who did not make payments during the pause are going to have less disposable income available in their budgets. As a result, less money will be available to put toward other financial goals and financial emergencies that may come up.

Before payments resume, now is the time to make sure you have a healthy emergency fund in place. Theres some debate among financial experts, but most recommend saving enough to cover 3-6 months of expenses.

Midterm Elections Are Coming

With the November midterm elections right around the corner, the president may be hesitant to address the divisive student loan situation. Biden supported canceling at least $10,000 of federal student loan debt during his 2020 presidential campaign, but Democrats and Republicans have remained divided on whether student loans should be forgiven on a large scale.

Some proponents have called on Biden to cancel upwards of ,000 in student loans per borrower, whereas opponents have shut down the idea of broad student loan forgiveness entirely. Soaring inflation has become another complicating factor, with broad student loan forgiveness having the potential to increase the buying power of a significant number of Americans at a time when policy makers are looking to tamp down consumer demand.

Restarting student loan payments two months before an election would be political suicide, according to higher education expert Mark Kantrowitz. Other than the political considerations, there is no valid justification for a further extension to the payment pause and interest waiver, he says.

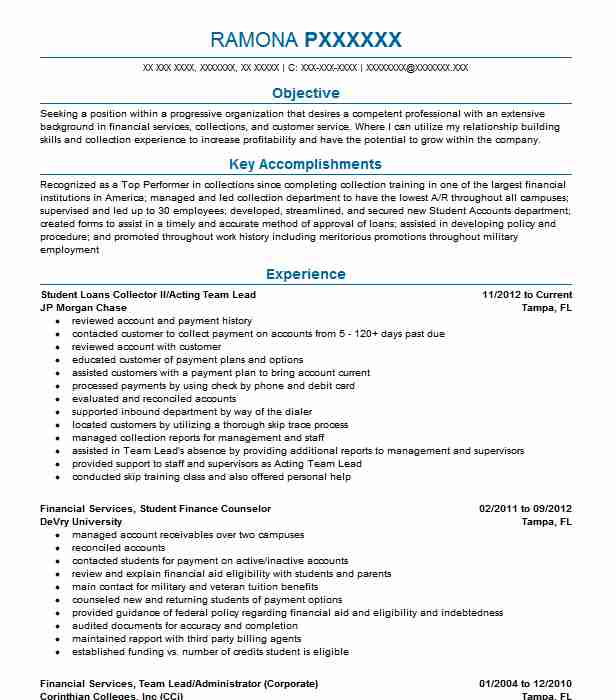

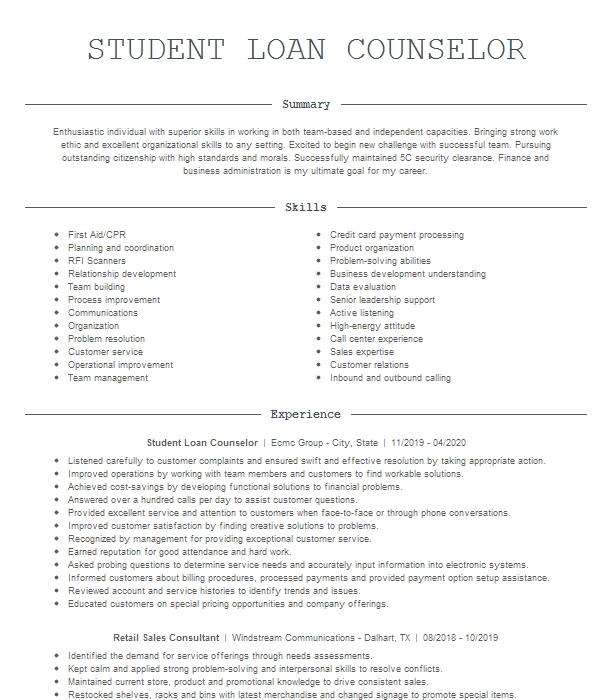

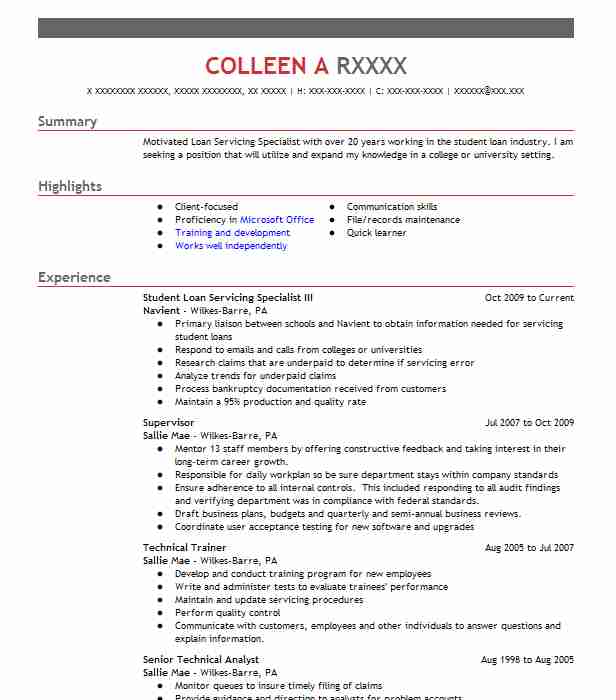

Recommended Reading: How To Write A Proper Resume And Cover Letter

With Student Loan Payments Set To Resume On Jan 1 2023 Administration Is Preparing To Launch Largest Student Debt Forgiveness Program In Us History

Listen to article

WASHINGTONThe Biden administration is gearing up for a major test of the federal governments bureaucracy: tens of millions of applications for student debt relief.

Later this month, the administration will launch the largest student loan forgiveness program in U.S. history. The government and the servicers who manage the federal student loan portfolio will have less than three months to process the initial batch of applications and ensure balances are adjusted before Jan. 1, 2023, when borrowers are due to start making mandatory payments on their loans for the first time in nearly three years.

Continue reading your article witha WSJ membership

Get Ready For Federal Student Loan Forbearance To End

Beginning in March 2020, the Covid-19 student loan forbearance paused payments for millions of federal student loan borrowers and set interest rates at 0%. It also meant that borrowers in default could not have their wages garnished, and those enrolled in the Public Service Loan Forgiveness program could still have the time in forbearance counted toward their eligible payments.

After several extensions throughout the pandemic, President Joe Biden had planned to extend the Covid-19 student loan relief one more time, to Feb. 1, 2022. But the announcement drew widespread criticism, as Covid cases resurged in many parts of the country and consumers are struggling with record-setting inflation.

By mid-December, President Biden announced another extension of federal student loan forbearance, and payments are now set to resume after May 1, 2022.

Recommended Reading: How To Mention Awards In Resume Sample

What To Do If You Cant Afford Student Loans After Payments Resume

A Bankrate survey from April 2022 found that 74 percent of U.S. adults with federal student loans predicted that an extension of the student loan forbearance period would have a positive impact on their finances. With these additional months to prepare for repayment, borrowers have more time to create a plan for their student loans and potentially explore more relief options.

When Do Student Loan Payments Resume

The pause on student loan payments was set to end August 31, but as part of President Bidens student loan forgiveness program, the moratorium on payments, interest accrual, and collections on most federal student loans has been extended one final time through December 31, 2022.

One of the first actions the federal government took after the breakout of the COVID-19 pandemic was to suspend student loan payments. All federal student loans were placed into forbearance, and the interest rate was set to 0% on March 13, 2020.

While payments were originally set to resume later in 2020, theyve been pushed back several times under both the Trump and Biden administrations. Now that the White House has announced student loan forgiveness up to $10,000 for most borrowers and $20,000 for PELL grant recipients, the pause through December is supposed to be the final extension. Read More:

If you still have a balance after student loan cancellation, heres what you need to know about payments resuming.

Also Check: How To Write A Objective Statement For Resume

Fact Sheet: President Biden Announces Student Loan Relief For Borrowers Who Need It Most

A three-part plan delivers on President Bidens promise to cancel $10,000 of student debt for low- to middle-income borrowers

President Biden believes that a post-high school education should be a ticket to a middle-class life, but for too many, the cost of borrowing for college is a lifelong burden that deprives them of that opportunity. During the campaign, he promised to provide student debt relief. Today, the Biden Administration is following through on that promise and providing families breathing room as they prepare to start re-paying loans after the economic crisis brought on by the pandemic.Since 1980, the total cost of both four-year public and four-year private college has nearly tripled, even after accounting for inflation. Federal support has not kept up: Pell Grants once covered nearly 80 percent of the cost of a four-year public college degree for students from working families, but now only cover a third. That has left many students from low- and middle-income families with no choice but to borrow if they want to get a degree. According to a Department of Education analysis, the typical undergraduate student with loans now graduates with nearly $25,000 in debt.

- Provide relief to up to 43 million borrowers, including cancelling the full remaining balance for roughly 20 million borrowers.

These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example:

Check Your Loan Status

If you were in default before the start of the pandemic, then you may be able to apply to be put in good standing when payments resume.

Thats due to the so-called Fresh Start program, an effort by the Biden administration to bring approximately 7.5 million borrowers out of default. Doing so will enable these borrowers to regain access to payment options like income-driven repayment plans, to get back on track for forgiveness, and to avoid collection efforts, including wage garnishments and fees.

Once the program officially launches, defaulted borrowers will be able to choose a new repayment plan at MyEdDebt.Ed.Gov. At that point, the loans will be transferred from Maximus, the servicer that handles defaulted student loans, to a new loan servicer, according to a fact sheet from the Department of Education.

After the transfer, the default status will be removed from the borrowers credit reports. Borrowers have one year from when the payment pause ends to apply for a new payment plan.

Sign up for the Fortune Features email list so you dont miss our biggest features, exclusive interviews, and investigations.

Also Check: Resume Examples For Registered Nurse

Student Loan Payments Will Resume In January But You May Have A New Loan Servicer

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

Cynthia Paez Bowman

Cynthia Paez Bowman is a finance, real estate and international business journalist. Besides Bankrate.com, her work has been featured in Business Jet Traveler, MSN, CheatSheet.com, Freshome.com and SimpleDollar.com. She owns and operates a small digital marketing and public relations firm that works with select startups and women-owned businesses to provide growth and visibility. Cynthia splits her time between Los Angeles, CA and San Sebastian, Spain. She travels to Africa and the Middle East regularly to consult with women’s NGOs about small business development.

If Navient was your federal loan servicer, your loans have been transferred to Aidvantage.

Why it matters

With the federal loan pause ending at the end of the year, you’ll want to know how to log into Aidvantage’s website to view your student loan account.

Here’s everything you need to know about what happened to Navient, and how to log in to your new Aidvantage student loan account.

How To Prepare For The End Of The Forbearance Period

For those without a plan for resuming payments, McBride suggests starting to budget now. Take a look at your finances and see if youre in good shape to continue making your payments. You should also take advantage of the federal protections and benefits that are offered to you, especially if youve experienced a recent loss in income and need a lower monthly payment.

Some options available to borrowers include:

Also Check: How To Have A Resume With No Experience

Will Federal Student Loan Forbearance Be Extended

The CARES Act not only paused payments on federal student loans but also dropped interest rates to zero and halted collection efforts by the Department of Education on loans that are in default.

The initial provision was slated to end September 30, 2020, but the Trump and Biden administrations both issued extensions. The moratorium’s expiration has been extended several times, but along with its announcement of student loan forgiveness in August 2022, the Biden administration said this payment extension would be the last. The deadline will give student loan borrowers additional time to plan for resuming monthly student loan payments once the pause on payments ends December 31, 2022.

‘we’re Not Being Heard’

TJae Freeman, a recent graduate of the University of Texas, said without the pause of student loan payments during the pandemic, she might not have been able to balance her other financial obligations, such as rent, utilities and groceries. Freeman, who is a market research associate, said the pause allowed her to save some money, but now shell have to readjust her finances in February when payments resume.

It’s just another reminder that we’re not being heard and our concerns are not being taken into consideration, Freeman said. It also is stress-inducing, because a lot of people are in the same situation with being a graduate and also just now working. So we don’t really have time to get everything in order and plan to start paying for loans.

Freeman, who has at least $25,000 in student loans, said it feels like the Biden administration is not taking her concerns and the concerns of the people who voted for Biden into consideration. She said Biden should cancel some of the student debt, or continue to pause the payments until the pandemic ends.

We’re still in a pandemic. The pandemic has not ended, Freeman said. For a lot of people, it’s been harder for them to find jobs or even work, so I feel like the payments should not restart until the pandemic is over with, and we have that pressure off.

Recommended Reading: What Should You Name A Resume

Will There Be Any More Student Debt Forgiveness

Judging by the length of time it took Biden to make a decision on widespread student loan debt forgiveness, it’s unlikely that any further forgiveness will be given to all student loan borrowers via executive order. It’s not clear yet if Biden’s current order to cancel $10,000 to $20,000 for all federal student loan borrowers will be challenged in court or if anyone even has the standing to file a lawsuit against it.

The political climate on student loan debt forgiveness is likewise murky: An Ipsos/NPR poll found that a majority of Americans approve of canceling $10,000 of student loans, but support for forgiveness decreased at higher levels of relief. In addition, 59% of Americans are worried that student loan forgiveness will make inflation worse. According to a separate CNBC/Momentive survey from early August, nearly a third of respondents opposed student loan forgiveness for anyone.

While further widespread student loan debt forgiveness is unlikely, the Department of Education continues to discharge loans of specific borrowers — the agency has canceled $32 billion of student loans during Biden’s term. Following temporary changes to the Public Service Loan Forgiveness program in October 2021, more than 175,000 borrowers have had their student loans extinguished, totaling more than $10 billion as of August 2022.

‘another Payment Freeze Is Inevitable’

Earlier this month, White House press secretary Karine Jean-Pierre said Biden would make a decision on the student loan payment pause by the end of the month. The president has also said he’d announce how he plans to move ahead, if at all, with student loan forgiveness before then. He’s come out in support of canceling $10,000 for all borrowers, but is under intense pressure to deliver greater relief.

It’s now just two weeks before federal student loan bills are set to resume, and although there’s much speculation that another extension is likely with no plan to restart the payments in motion and the November midterms looming, the White House has said nothing else on the matter.

“The fact that they haven’t issued any guidance so close to the theoretical start date pretty much indicates yet another payment freeze is inevitable,” said Barmak Nassirian, vice president for higher education policy at Veterans Education Success, an advocacy group.

You May Like: How To Write Dean’s List In Resume

I’m In The Public Service Loan Forgiveness Program Will My Suspended Payments Count Toward Pslf

Yes, paused payments count toward PSLF as long as you meet all otherqualifications. You will receive credit as though you made on-time monthly payments in the correct amount whileon a qualifying repayment plan. Borrowers may receive credit toward PSLF during the payment pause if they laterenter the PSLF program. For more information, review the COVID-19Public Service Loan Forgiveness page on Federal Student Aid’s website. We also encourage you to learn more about thelimited PSLF waiver, which ends October 31, 2022.

What Is The Public Service Loan Forgiveness Program

If you’ve worked in public service, such as the government, military or nonprofit organizations, for at least 10 years you could be eligible for total student loan debt forgiveness through the Public Service Loan Forgiveness program. Temporary changes to the program, which end Oct. 31, currently make receiving forgiveness easier and more flexible.

Read Also: What Does Cover Letter Means In A Resume

Update Your Contact Info

A lot can happen in two and a half years. You need to log into your Federal Student Aid account and make sure that all of the information is up-to-date.

While youre there, check which company is servicing your loans, as millions of borrowers have had their loans transferred to new payment companies since they last made a payment. You can find who your servicer issome of the companies include FedLoan, Mohela, Nelnet, and Great Lakes Educational Loan Servicesby going to the My Aid section of the FSA website, and then clicking View loan servicer details.

Cant Afford Your Monthly Payment

Consider applying for an income-driven repayment plan. An IDR plan can make your payments more affordable, depending on your income and family size. If youre not eligible for an IDR plan, reach out to your loan servicer. Your loan servicer can work with you to help you understand your options.

If youre interested in lowering your student loan payments to more aggressively pay off your credit card debt, call DebtWave Credit Counseling, Inc. at 888-686-4040.

Recommended Reading: How To Write Paper Publication In Resume

Did Any Interest Accrue During The Covid

The interest rate during the entire COVID-19 payment pause is 0%, so no interest has accrued during this period.

Any previous unpaid interest will not capitalize during thepayment pause and through June 30, 2023, six months after the payment pause is scheduled to end. The earliest interest will capitalize would be July 1, 2023. GreatLakes will reverse and delay any interest capitalization that has an effective date of March 13, 2020, throughJune 30, 2023.

For more information about interest capitalization, see”Top Six Ways to Reduce What You Owe“and scroll to section #2.

Pay Down High Interest Debt

While interest rates on federal student loans are definitely on the rise for students who borrow during the 2022-23 academic year, individuals who already have federal student loans will pay the same rate they were paying before March of 2022 once federal student loan payments resume.

Regardless, it almost always makes sense to pay down high interest debt over federal student loans, which come with low fixed interest rates that never change. After all, the average interest rate on credit cards is currently nearing 18%, and many credit cards have significantly higher rates than that.

Recommended Reading: What Is A Summary Statement On A Resume