Watch For Notices From Us

Great Lakes and Federal Student Aid have sent, and will continue to send, communications to help get you prepared forrepayment. Read these notices carefully, as they have important tips about what to expect.

As the end of the payment pause grows nearer, we will send you a billing statement about three weeks beforeyour due date. If you previously had a bill pay service set up with your bank, you may have to set that backup again. Refer to “I previously made monthly payments using a bill pay service. How do I continue usingthat payment method when repayment starts?” in theFAQs below.

In addition, if you were previously using Auto Pay to make your monthly payments before March 13, 2020, and you haven’t confirmed your enrollment, you’ll still need to confirm by logging in to your mygreatlakes.org account, selecting Payments, then selecting Auto Pay.

If you haven’t already, you must confirm that you want to remain in Auto Pay for your payments to be madeusing that method. If you do not elect to stay enrolled in Auto Pay, it willbe cancelled, you’ll lose the 0.25% reduction on your interest rate, and you’ll need to make other paymentarrangements when the COVID-19 payment pause ends. Log in to yourmygreatlakes.org account, and you’ll beprompted to confirm enrollment in Auto Pay.

Black And African American Borrowers

According to a January 2022 poll conducted by CNBC and Momentive, 68% of surveyed U.S. adults have some form of debt, including student loans. One in four Black adults has federal student loans, compared to 15%, 14%, and 11% for Hispanic, White, and Asian Americans, respectively.

Not only are Black and African American borrowers more likely to have student loan debt, but they also owe more on average. According to the Board of Governors of the Federal Reserve System, Black borrowers took out the largest average amount of federal student loan money in 2019 at $44.88 thousand, compared to $40.17 thousand and $30.89 thousand for their White and Hispanic counterparts, respectively.

When Do Student Loan Payments Restart Jan 1 2023

Stanley tate

âInterest, payments, and collections on most federal student loans will restart after the forbearance ends on Dec. 31, 2022.

The Education Department announced today that President Joe Biden was extending the pandemic-era pause on student loan repayment, first implemented under the Trump administration, through Dec. 31, 2022.

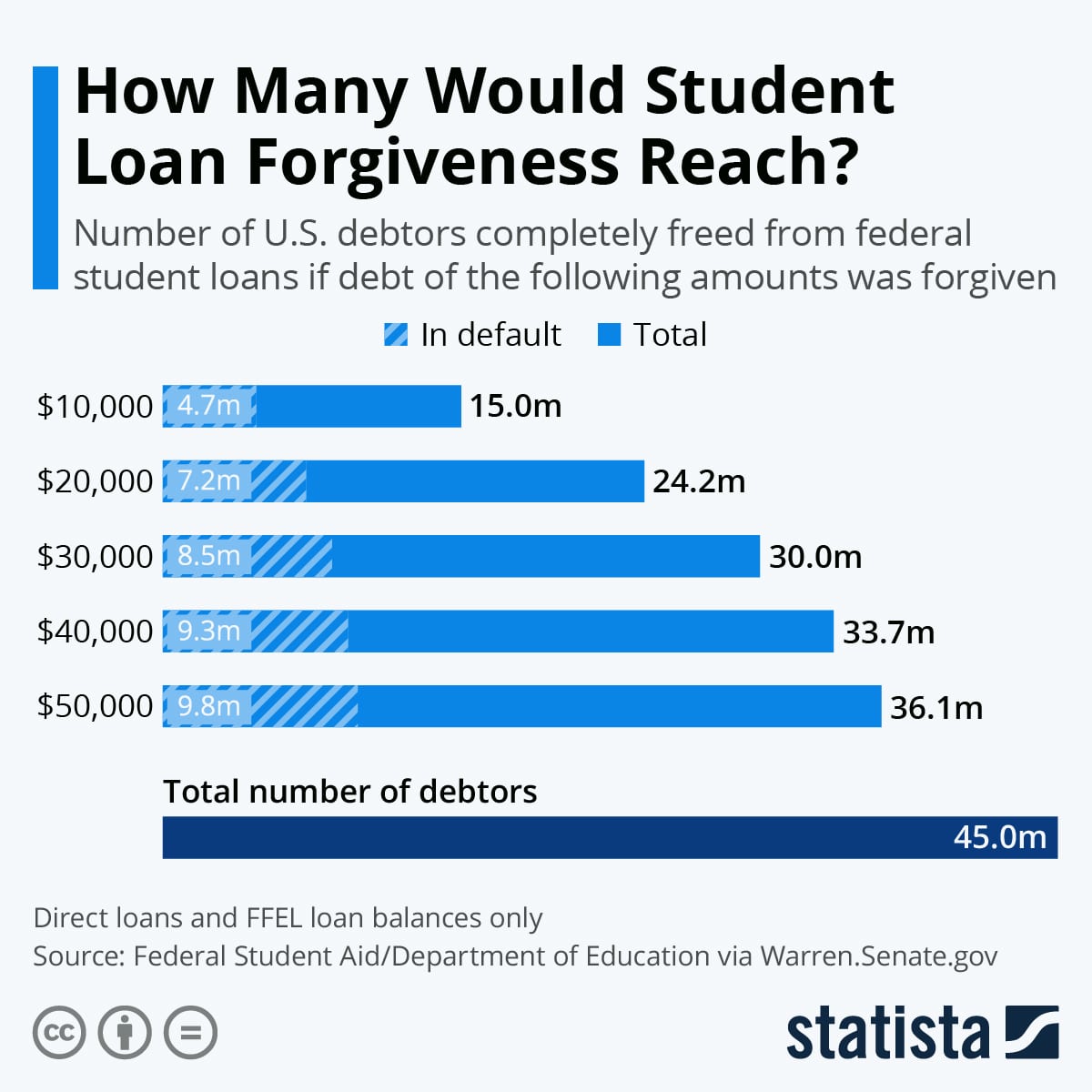

The president is also bringing student loan relief to millions of Americans by knocking off at least $10 thousand from their balances in the next few months. Pell Grant recipients â a federal grant to pay for higher education â can get double that amount. The Biden administration anticipates that the mass debt cancellation will provide relief to 43 million borrowers â if everyone claims the relief theyâre entitled to receive.

The announcement arrives ahead of the midterm elections and could give the Democrats a boost with some voters. But it could also threaten their standing with Republicans and those who say the amount being forgiven isnât enough â or too much.

Ahead, learn more about when federal student loan payments resume.

Learn More:

You May Like: How To Respond To A Resume Received Email

When Do Student Loans Resume What Does That Mean For Sofi Stock

Investors are mixed on SoFi ahead of resuming loan payments and new loan forgiveness proposals

- Investors are scratching their heads over SoFi lately after President Joe Biden’s newest proposed student loan forgiveness regulation.

- The legislation would expand eligibility for student loan forgiveness and sets the stage for the long-touted $10,000 universal loan cancellation.

- SoFi has been touch and go since the loan pause first began in 2020.

- Ahead of the return of loan payments some believe the company is positioned to benefit — should the moratorium truly end.

Fans of SoFi stock have cause to rejoice ahead of the return of student loan payments. The loan lender has long suffered as a consequence of the federal student loan moratorium. So, when do student loans resume?

As of today, federal student loan payments technically restart on Sept. 1, 2022. With that said, President Joe Bidens administration recently released a series of potential refinancing, repayment and student loan forgiveness proposals that may assist students not yet ready to resume payments.

On Wednesday, Bidens education department proposed $85 billion in student loan cancellations. This includes $46 billion in the cancellation of outstanding loans and $39 billion for future loan cancellations over the next 10 years.

The proposed changes also stipulate generous modifications to policies related to interest capitalization, borrowers with disabilities and borrowers who work in public service.

Will Student Loan Repayment Ever Actually Resume Again Probably Not For Awhile Heres Why

US President Joe Biden addresses trades leaders at the Washington Hilton Hotel in Washington, DC, on … April 6, 2022.

AFP via Getty Images

Last week, President Biden announced another extension of the ongoing pause on student loan payments and interest accrual.

For over two years, student loan repayment has been suspended and interest has been frozen. The relief first codified by Congress through enactment of the CARES Act in March 2020 was supposed to last just six months. But President Trump, and then President Biden, issued multiple short-term extensions. Bidens most recent extension to August 31, 2022 added yet another four months to the pause.

But theres reason to believe that student loan payments wont actually restart even in September. And theres a pretty good chance that the payment pause will be extended yet again, perhaps to the end of the year or beyond. Heres why.

You May Like: How To Make A Visually Appealing Resume

What Happens To Borrowers Who Were In Default

Borrowers in default will automatically be given a “fresh start,” according to the US Department of Education. All defaulted accounts will be returned to good standing, and any delinquencies will be “cured,” allowing borrowers to repair their credit and access programs like income-driven repayment plans and Public Service Loan Forgiveness, a student loan relief program designed for borrowers who work for the government or nonprofit organizations.

Since the federal student loan payment pause began in March 2020, collections on defaulted debts have been put on hold.

In an , Secretary of Education Miguel Cardona said, “During the pause, we will continue our preparations to give borrowers a fresh start and to ensure that all borrowers have access to repayment plans that meet their financial situations and needs.”

See If Youre Eligible For Any Loan Forgiveness Programs

President Joe Biden announced multiple rounds of student loan forgiveness this year, aimed at borrowers with total and permanent disabilities, students who attended now-defunct institutions, and public servants.

You can check your eligibility on the Federal Student Aid website and your servicers website.

This will ensure that you receive any critical reminders about when your bill is due, how big your payment is, or if youre eligible for any modifications via the extended Public Service Loan Forgiveness waiver.

You May Like: Rocket Resume Phone Number

Will Student Loans Be Paused Again

As the COVID-19 pandemic continues to affect millions of Americans, many are wondering if student loan payments will be paused again. The answer is unclear at this time, as the situation is fluid and ever-changing.What we do know is that the CARES Act, which was passed in March 2020, suspended student loan payments through September 30, 2020. This pause applied to all federal student loans, including Direct Loans, Stafford Loans, and PLUS Loans. Private student loans were not included in this relief measure.Now that were approaching the end of September, theres been no word from the government about whether or not thepause on student loan payments will be extended. With so much uncertainty surrounding the future of the pandemic and the economy, its difficult to say what will happen next.If youre struggling to make your student loan payments, reach out to your lender or servicer for more information about your options. You may be able to temporarily lower your payment amount or sign up for an income-driven repayment plan. Remember that taking advantage of these options may extend the length of your loan and increase the total amount youll need to repay.

Do Private Loans Qualify For Student Loan Debt Forgiveness

Private loans do not qualify for any federal-government-sponsored loan forgiveness programs. However, private student loan borrowers may qualify for refinancing through independent financial institutions.

Your lender or servicer may offer forbearance and deferment options. They may also offer refinancing. Reach out to your loan servicer to find out what options are available to make your private student loan debt more manageable.

Don’t Miss: Indeed Employer Login Resume Search

If You Have Parent Plus Loans

Look into changing repayment plans. The Extended or Graduated plans stretch your repayment term over 25 or more years and give you a payment amount that either stays the same or goes up every few years. Those plans are good options if youâre still working and have a high income.

But if you need a lower payment because youâre about to retire or are already drawing Social Security benefits, look into the income-contingent repayment plan. The ICR plan caps your monthly payment at 20% of your income. You could have a zero-dollar bill if Social Security benefits are your only source of income when the moratorium ends.

Learn More:How to Pay Off Parent Plus Loans

The Economy Could Be In Trouble

Administration officials have repeatedly said that they would consider economic factors when deciding whether to issue another extension of the student loan payment pause.

The U.S. economy is currently under pressure, with inflation still at a four-decade high and new signs the country could be in for a recession. Interest rates are rising and regardless of whether were technically in a recession or not, many Americans hold the view that the economy is in trouble. This could play into the administrations decision on whether to extend the pause or not in the near term, experts say.

Excessive inflation has increased prices for almost everything and most borrowers are likely not in a position to pay off their loans, says Tony Aguilar, founder and CEO of Chipper, a student loan repayment app. An additional extension also provides the White House with more time to review potential forgiveness plans.

You May Like: Resume Template For First Job

Once You’re In Double Check Your Payment Preferences

Any payment terms you set up with Navient — autopay, deferment, income-driven repayment plans — should have transferred seamlessly to Aidvantage. Since federal student loan payments have been paused for more than two years, you may need to review the payment details, particularly with the end of forbearance approaching.

If your job situation has changed since you last reviewed your loan repayment options, you may want to apply for income-driven repayment or other repayment options through Aidvantage now, so you’re ready to go when repayment begins in September.

What Are Some Resources For Budgeting And Managing Your Student Loan Payments

The first step in creating a budget is knowing how much money you have coming in and going out each month. This will give you a better idea of where you can cut back and where you may need to make some adjustments.

There are a couple of different ways to get this information:-Look at your bank statements from the past few months to see what your average spending is.-Create a spending diary for a month and track every penny you spend. This can be done with a simple notebook or using an app like Mint or You Need A Budget .-Once you have an idea of your average monthly income and expenses, you can start working on a budget that works for you.

There are a number of different budgeting methods out there, but one of the simplest is the 50/30/20 rule. This method suggests that you break down your after-tax income like this:-50% goes towards essential expenses like housing, food, transportation, and utilities-30% goes towards discretionary spending like entertainment, eating out, shopping, etc.-20% goes towards savings and debt repayment

Read Also: How To Write A Nursing Resume

What To Do If You Cant Afford Your Payments

Unfortunately, millions of Americans are still facing financial hardship from the pandemic. A recent Pew Research Center report found that about half of non-retired adults will have a hard time reaching financial goals because of financial setbacks from the pandemic.

For many, these financial setbacks will make it hard to make student loan repayments. If you dont think youll be able to afford your payments in September 2022, you can:

Unfortunately, millions of Americans are still facing financial hardship from the pandemic. A recent Pew Research Center report found that about half of non-retired adults will have a hard time reaching financial goals because of financial setbacks from the pandemic.

For many, these financial setbacks will make it hard to make student loan repayments. If you dont think youll be able to afford your payments in January, even after student loan forgiveness, you can:

Important Dates In 2022 For Student Loan Borrowers

November 24, 2021 by Amy Blitchok

With the holiday season upon us, things are about to get busier than usual for most people. Thats why we wanted to take a minute to remind you about some important dates that are coming up in 2022 for student loan borrowers. Be sure to mark your calendar for these dates.

You May Like: How To Address A Resume Cover Letter

Student Loans Are On Hold Should You Pay Anyway

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Keep your guard up: How to spot a student loan scam

Payments are currently suspended, without interest, for most federal student loan borrowers through Dec. 31, 2022. This policy does not apply to private student loans.

Borrowers can still make payments to lower their debt during this period of suspended payments, called a forbearance. According to the latest federal data, a total of 500,000 borrowers continued making payments during the pause. Contact your servicer if you have further questions.

» MORE:Can Student Loan Borrowers Handle Payments and Inflation, Too?

Make no mistake: This is a pause on payments, not cancellation. While the Biden administration has unveiled a broad cancellation plan for up to $20,000 in federal loan debt, your remaining debt will be waiting for you when repayment begins at the end of the forbearance, unless the policy changes again.

Until then, heres how to decide what to do next.

What Does The Cares Act Do

The Coronavirus Aid, Relief, and Economic Security Act was passed by Congress and signed into law on March 27th, 2020. The CARES Act is designed to provide emergency financial assistance to individuals, families, and businesses affected by the coronavirus pandemic.

One provision of the CARES Act suspends all federal student loan payments until September 30th, 2020. This includes both principal and interest payments. Additionally, any loans that are currently in deferment or forbearance will automatically be placed into a temporary administrative forbearance until September 30th, 2020. This means that you will not have to make any student loan payments until at least October 1st, 2020.

If you have a Direct Loan or a Federal Family Education Loan , you can choose to make no payments until September 30th, 2020, or you can choose to continue making payments if you want to. If you have a Perkins Loan, your payments will be suspended automatically until September 30th, 2020.

The CARES Act also provides that no interest will accrue on your federal student loans during this time period. This includes all Direct Loans, FFEL Loans, and Perkins Loans.

You May Like: How To Add Self Employment To A Resume

Speak With Your Employer

More organizations have begun offering student loan debt assistance to their employees, whether through information sessions about specific loan programs or by offering to help pay off their employees debt.

Student debts impact on your income could be putting a dent in your overall financial wellness. And one place you might not always look for support to help offset these expenditures is your employer.

Some companies may give direct payments for student loan repayment. Others will make direct after-tax donations to assist pay down their employees debt, urging borrowers to inquire about their available options.

In general, employment support can assist you in paying down debt more quickly, which can help you save more for short-term needs, such as emergency savings.

Should I Pay My Student Loans During The Payment Pause

If you’re able to, paying during the pause can lower your principal loan amount, helping you save money on interest when payments resume.

The only borrowers who may not want to consider paying now are those working towards Public Service Loan Forgiveness. During the payment pause, each month counts toward your 120 qualifying payments — whether you’re paying or not. So there’s little benefit to making payments during the freeze.

Get the CNET Personal Finance newsletter

Also Check: What Is A Job Category On A Resume

Change Your Payment Method If Possible

You may also be eligible to change to income-driven repayment plan, which calculates an affordable student loan monthly based on a borrowers income and family size. The FSA office offers four IDR choices, each of which limits monthly payments to 10% to 20% of a borrowers income.

Rates are set to assist borrowers in repaying their loans within a 20- to 25-year time frame.

Looking into an IDR plan makes a lot of sense for people whose income has been reduced during the epidemic to see if the monthly payments would be lower than the new salary.

Debt Consolidation and Refinancing Can Also Help

Other options to consider are debt consolidation and refinancing. Debt consolidation is when you combine your different student loans into a single loan. For example, a couple of federal student loans and a private student loan.

Some borrowers consolidate their student loans to qualify for the Public Service Loan Forgiveness program, which exclusively considers federal direct loan payments when calculating debt forgiveness.

Refinancing is another option for people with student loans. This option may enable you to get a lower interest rate and change your monthly payment amounts to align more closely with your budget.

However, student loan refinancing is not without drawbacks since you would be changing your loans from federal to private loans losing access to federal benefits.