Tips For Eating Out And Grocery Shopping On A Budget

The costs of student loan payments can make paying for everyday necessary expenses, like food, seem daunting. However, with careful budgeting, it is possible to eat out and cut back on food and grocery costs during loan repayment.

While dining at a favorite neighborhood steakhouse is tempting, it can quickly consume your budget, said Kevin Steward, co-founder of USBadCreditLoans. These luxuries should be reserved for special occasions. Eat out, take out and order delivery food once a month. Purchase your groceries in bulk.

More From GOBankingRates

Side Gigs To Consider

When it comes to paying back student loans, a side gig can help alleviate financial stress and generate income.

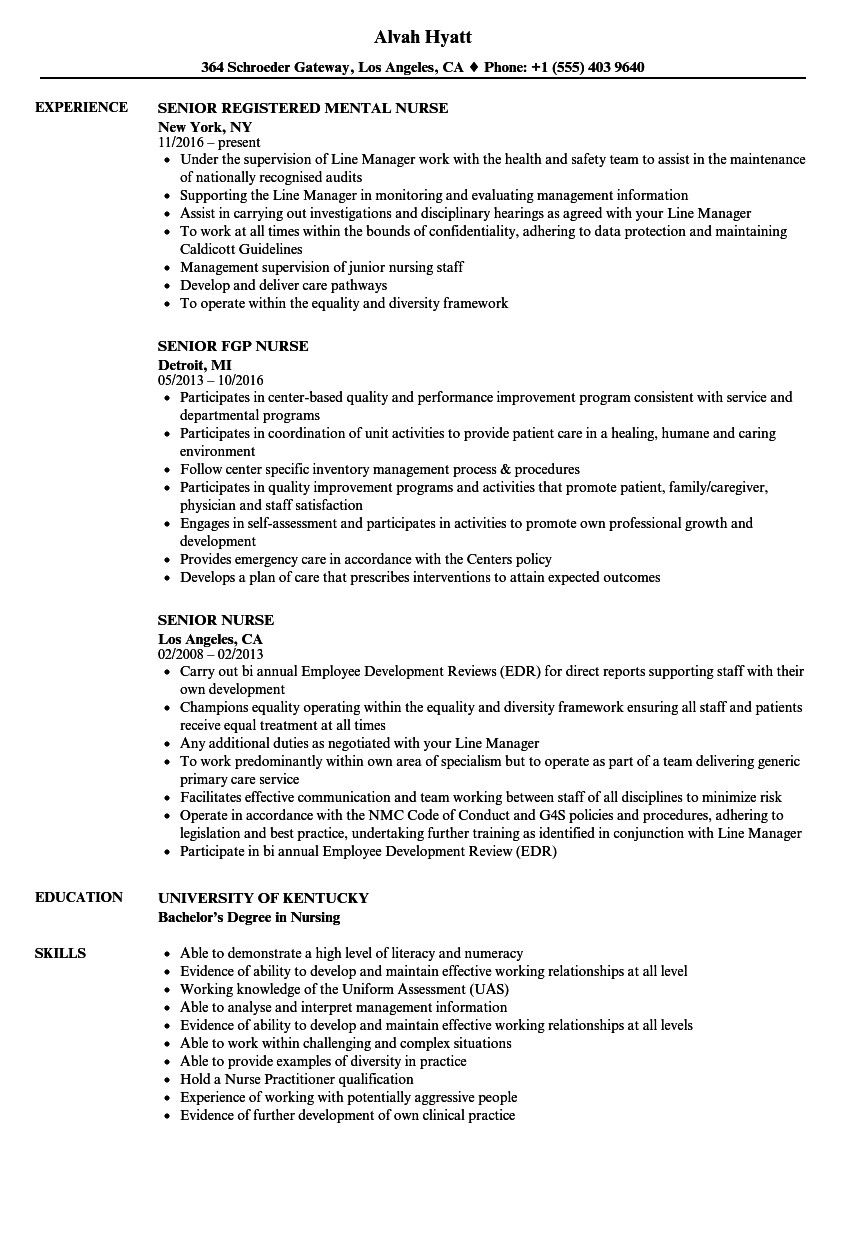

Some of the side gigs that may help are freelancing, evening jobs and working overtime for extra pay where that may apply, said Tracy Ackler, CEO and recruiter at GetPaydayLoan. Part-time jobs that may fall into these categories include yard maintenance, bookkeeping, remote writing, consulting and web design.

It is important for borrowers to find a side gig that works with their schedule and skills in order to maintain loan repayments and avoid burnout.

POLL: Do You Think Student Loan Debt Should Be Forgiven?

Student Loan Payment Pause Continues Through August

For over 26 months, payments on most federal student loans have been paused, and interest has been set to zero. Collections efforts against defaulted federal student loan borrowers have also been suspended.

That relief was originally provided through the CARES Act, which Congress passed in March 2020 in response to the Covid-19 pandemic, and it was supposed to last for six months. But President Trump, and subsequently President Biden, issued a series short-term extensions. Bidens most recent extension is now set to end on August 31, 2022, which means billing would resume in September.

You May Like: What Should I Write In Email When Sending Resume

Will Student Loan Debt Be Canceled

A number of Democrats are pressing President Joe Biden to cancel up to $50,000 in student loan debt, including Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren. Soon after taking office, Mr. Biden said that Congress would need to act to cancel student loan debt. But in the spring, the president asked the Education Secretary to outline his legal authority to cancel student loan debt.

“We’re working very hard with the Justice Department and the White House to look at our potential legal authority, and those conversations are ongoing,” said Kvaal.

Even as a determination has yet to be made, the administration has taken some steps to wipe out certain student debt. Since January, the administration has approved the cancellation of more than $12.5 billion in student loans affecting roughly 640,000 borrowers, according to the Education Department. That includes discharges for permanent disabilities, those found to have been defrauded by schools, and forgiveness for public service.

What Will My Payment Be When Payments Start Again

For those on an income-driven repayment plan, your payment will resume at what it was prior to your payments being suspended. Whats unclear, though, is when borrowers have to recertify their income to update their payments.

Previously, Student Aid advised that all recertifications between Mar. 13, 2020 and Dec. 31, 2020 would be postponed 12 months.

Now, its guidance simply states that your recertification date has been pushed out from your original recertification date, and that youll be notified of your new recertification date before the deadline.

With that said, you might have to recertify closer to payments resuming come October or wait until your postponed recertification anniversary date. Stay tuned here.

Recommended Reading: How Many References Should You List On A Resume

Some Democrats Say Biden Isn’t Going Far Enough

News of the extension leaked Monday, and Democratic lawmakers, including Senate Majority Leader Chuck Schumer, were quick to push the president for further action with some angling for student loan cancellation.

On Wednesday, Democratic lawmakers, including Rep. Ayanna Pressley and Sens. Elizabeth Warren and Schumer, issued a statement saying the extension was welcome, but more action would be required.

“We continue to implore the president to use his clear legal authority to cancel student debt, which will help narrow the racial wealth gap, boost our economic recovery, and demonstrate that this government is fighting for the people,” the statement read.

Sen. Patty Murray, D-Washington and the chair of the Senate’s committee on education, she was glad to see Biden take action but that the administration should “forgive some debt for all borrowers.” She also called on Biden to “fix” the student loan system and to extend the pause through year’s end.

Last week, dozens of Democratic lawmakers had sent a letter to Biden urging him to extend the pause through year’s end and to provide “meaningful student debt cancellation.”

Biden has said he is open to debt cancellation but that believes its Congress’ role to act.

What Borrowers Should Do

Thereâs no true indication that the Biden administration is considering another extension beyond May 1 at this point, Adam S. Minsky, a student loan lawyer, tells Fortune.

That being said, âanything is possibleâlast year, the administration repeatedly characterized the extension to Jan. 31, 2022 as the âfinalâ extension, only to extend it yet again at the last minute,â Minsky says.

But because thereâs still so much that remains unknown, borrowers should prepare to resume payments in May, student loan experts agree.

âI would not advise people to plan based on an assumption that there will be an extension of the program,â Bruce McClary, senior vice president of communications for the National Foundation for Credit Counseling , tells Fortune. âThe best advice for student loan borrowers who are taking full advantage of the forbearance period is to plan for a resumption of payments in May.â

See how the schools youâre considering landed in Fortuneâs rankings of the best business analytics programs, data science programs, and part-time, executive, full-time, and online MBA programs.

Recommended Reading: When Does Vikings Season 4 Resume

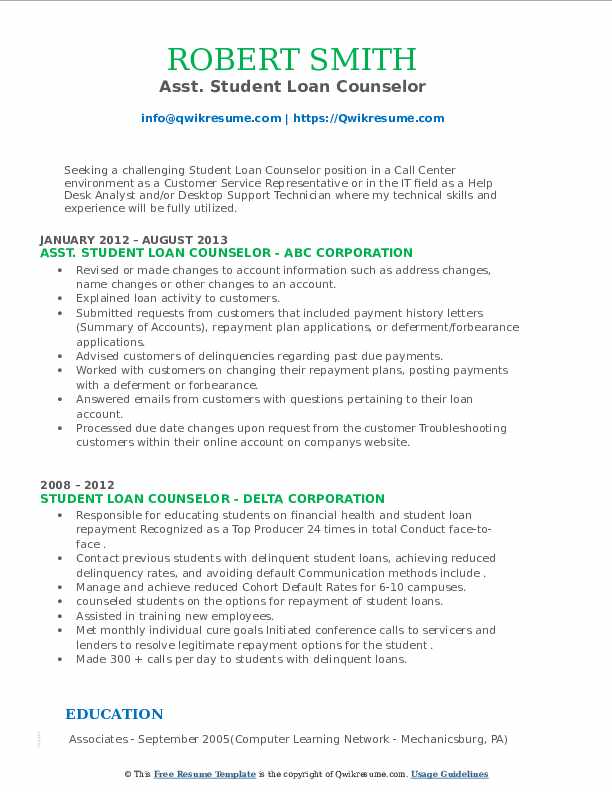

Consider Refinancing Your Student Loans

If you have several loans with high interest rates, you may want to consider refinancing these loans with a private lender. There are pros and cons to this approach. Although you can sometimes get a lower interest rate by refinancing, doing so means that you lose access to federal programs such as income-driven repayment and loan forgiveness programs. A financial planner or student loan expert can help you understand the ramifications and choose the best option for you, says Hansen.

The Pause Could Be Extended Again

Because the payment pause has been extended so many times, experts say borrowers are unlikely to take the latest announcement of bills resuming in September too seriously.

“What’s a borrower to believe or plan for anymore when the government keeps changing its mind?” said Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers.

And this time, the payments are scheduled to start back up again just a few months before the midterm elections, which many observers have said could trigger troubling headlines for Democrats and lower turnout at the polls for the party.

“I can’t see them restarting repayment two months before an election,” said higher education expert Mark Kantrowitz.

Recommended Reading: How To Put Ged On Resume Example

If You Don’t Think You Can Afford Your Monthly Bill Seek Out Additional Payment Options

The federal student loan program has a few options for lowering your monthly payment. Some are based on your balance others are based on your income.

“Thankfully there are a couple of really good tools out there to help borrowers figure out not only what their payment will be under each of those plans, but almost more importantly, how much they’ll pay in the long run under each of those plans,” Mayotte says.

The Loan Simulator, on the Department of Education’s website, and the Student Loan Calculator, developed by the Institute of Student Loan Advisors, are two tools that can help you figure out which payment program is right for you.

If you’re pursuing loan forgiveness programs, such as Public Service Loan Forgiveness, both of the calculators will also show whether these programs will actually pay off for you.

Will Automatic Payments Automatically Resume

It depends. If a borrower had automatic debit for student loans set up before the pandemic, it does not mean automatic payments will resume when the student loan pause ends. Borrowers should check with their providers about automatic payments.

“If they are not already in an auto-pay or auto-debit plan, they should consider signing up for one,” said college financial aid expert Mark Kantrowitz. “The lenders will give them a slight interest rate reduction as an incentive.”

For those with federal student loans, that incentive is typically a quarter of a percentage point.

Don’t Miss: Child Acting Resume Template No Experience

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Student Loan Payments Unlikely To Resume Right Before Midterm Elections

Restarting student loan payments just two months before major national elections could be politically disastrous for Democrats. The November elections will determine which party controls the House and the Senate. Democrats currently hold only narrow majorities in both chambers, and the party that holds the White House typically loses seats in Congress in midterm elections.

A poll released last month by Data for Progress and the Student Borrower Protection Center showed that a majority of borrowers supported extending the student loan payment pause to at least the end of 2022. Another poll released by the same organizations similarly suggested that voters may be less likely to vote in the midterms if the administration fails to provide adequate relief to student loan borrowers.

You May Like: What Font Size To Use For Resume

What Happens With Borrowers Who Will Have A New Loan Servicer

Some 16 million borrowers could have a new federal loan servicer when repayments kick back in. That’s because some companies, such as Navient, have ended contracts to service federal student loans. For those who are dealing with a new servicer, they should receive communications from both their former servicer and the new servicer about the changes and how to set up online accounts.

Experts encourage borrowers with a new servicer to carefully document all their loan information from their account with their old servicer and compare it with what is in the new servicer’s system. While information should be seamlessly transferred to the new servicer, like with any moves, there is always a chance of error so having records of loan amounts, payment details and interest rates are good to have available and cross-checked just in case.

% Of Student Loan Borrowers Say They Will Need A Side Gig For Supplemental Income

Its hard to imagine student loan borrowers, likely out of college and working a full-time job, having to take up a new side gig to account for the monthly repayments but it is the reality. According to survey respondents, 33% of Americans with student loans say they will need to take on a side gig when repayments resume.

Picking up a side hustle comes along with some extra responsibility, which borrowers might want to consider when choosing what type of side gig will work best for them.

If you take on a side-gig, make sure you are making estimated tax payments across the year, said Jay Zigmont, financial planner and founder of Childfree Wealth. It may seem simple and efficient to pick up a side-gig, but you are effectively running your own business and you are responsible for taxes, appropriate insurance and managing finances.

Also Check: Resume Multiple Jobs Same Company

Solutions Abound For Borrowers In Lead

Given that many borrowers dont know the basics of their debt more than half are unaware of their balance, according to our August 2021 survey its fair to assume that they might also be unsure about alternative options for relief if and when the moratorium expires.

Fortunately, there are many potential solutions for federal loans, including:

- Enrolling in an income-driven repayment plan to cap monthly dues at a percentage of the borrowers income

- Requesting a deferment or forbearance to pause repayment for months at a time in cases of unemployment, hardship and other scenarios

- Seeking student loan forgiveness and repayment assistance from the federal government, states and employers

Another route to consider is exchanging federal loans for one new private loan of the same balance but at ideally friendlier repayment terms. According to our survey, more than 7 in 10 borrowers who have refinanced their education debt report that their monthly payments are more affordable as a result.

With that said, just 12% of borrowers we surveyed have completed student loan refinancing. Interestingly, men are more likely to go through with refinancing than women .

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Younger millennial: 26 to 35

- Older millennial: 36 to 41

- Generation X: 42 to 55

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Political Positions Of Joe Biden

| This article is part of a series about |

Joe Biden, President of the United States, served as Vice President from 2009 to 2017 and in the United States Senate from 1973 until 2009. A member of the Democratic Party, he made his second presidential run in 2008, later being announced as Democratic presidential nominee Barack Obama‘s running mate in 2008. He was elected Vice President in 2008 and re-elected in 2012. In April 2019, Biden announced his 2020 presidential campaign. He became the presumptive Democratic nominee in April 2020, was formally nominated by the Democratic Party in August 2020, and defeated Republican incumbent Donald Trump in the .

Over his career, Biden has generally been regarded as belonging to the mainstream of the Democratic Party. Biden has been described as center-left and has described himself as such. Figures farther to the left such as Bernie Sanders have criticized Biden for not embracing Medicare for All or the Green New Deal. Biden’s policies emphasize the needs of middle-class and working-class Americans and have drawn political support from those groups. Various commentators and observers have likened Biden’s views and proposals to the populism of Ted Kennedy, whom Biden cites as a mentor, and to the Christian democracy of continental Europe.

Read Also: Using Present Tense In Resume

Understand Your Budget Goals

Reviewing your budget ahead of time will help you understand where you need to save to account for your student loan payments.

According to Reaves, consider the following options if adding student loan payments will leave you with a negative balance: Reduce your spending in other areas. You can do this by cutting back amounts allotted for discretionary and variable categories. You can also pause or temporarily terminate some bills to help you break even or increase the amount of income you make. Can you work overtime at your job to bring more money in? Can you get a part-time job or side hustle? Extra money can help you reduce your monthly deficit and leave you with extra money to save or put toward student loan payments.

Being informed about your budget will help you understand if you can afford the additional student loan payments or not. When you know that information, you can proactively work to prepare your finances for the new expense, adds Reaves.

Will Biden Pause Student Loan Payments Again

It remains to be seen whether the president will pause student debt payments by the time Aug. 31 arrives, but Cardona’s testimony in the Senate subcommittee hearing seems to indicate the option is at least on the table.

“Theoretically, Biden could continue to extend student loan relief through multiple executive orders, creating a student loan payment pause ‘forever,'” Zack Friedman, CEO of online financial marketplace Mentor, wrote in Forbes.

Or at least until he leaves office.

Read Also: How To Put Multiple Jobs At Same Company On Resume

What About Student Loan Forgiveness

Plenty of borrowers have been hesitant to make any major progress on paying off their loans in the hopes that the Biden administration will forgive a portion of federal student loans, as was a part of his campaign platform.

Read More:Bidens Plan for Loan Forgiveness

Its impossible to know what actions the administration will take on student loan forgiveness. And for borrowers with large amounts of student loan debt, loan forgiveness likely wouldnt wipe out all of their debt anyways.

Given the uncertainty, borrowers can use the time leading up to May 2022 to assess any developments in the situation. But once loan payments resume, each borrower will have to decide for themselves whether to try to aggressively tackle their loans, or simply make the minimum payments.